Welcome to our March 2025 Property Market Snapshot.

March in Review:

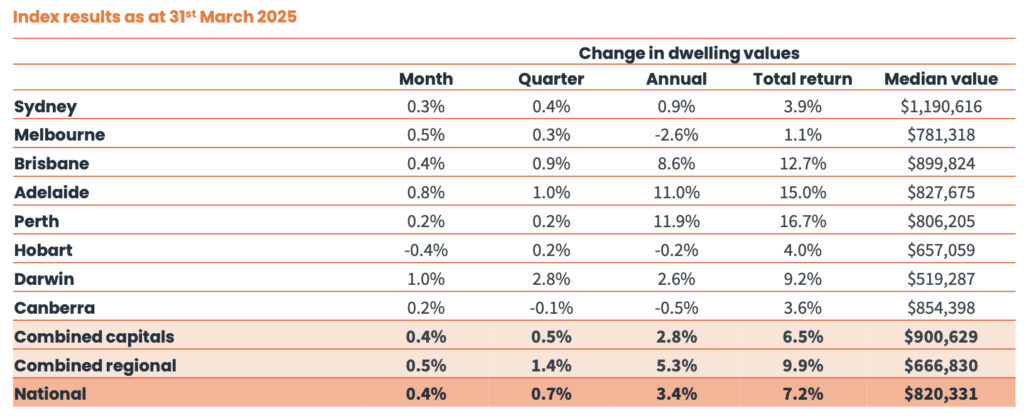

- Home Values: Australian home values rose 0.4% in March, reversing a recent downward trend and returning to record highs. This marks the second consecutive month of growth, following a short three-month period where values fell by 0.5%.

- Capital City Trends: Sydney rose 0.3% and Melbourne 0.5%, continuing their two-month recovery.

- Regional Markets: Regional housing markets continued to outperform, with values rising 0.5% compared to a 0.4% gain across the combined capitals. However, the growth trajectory is converging as capital city growth accelerates, while regional markets show steady performance.

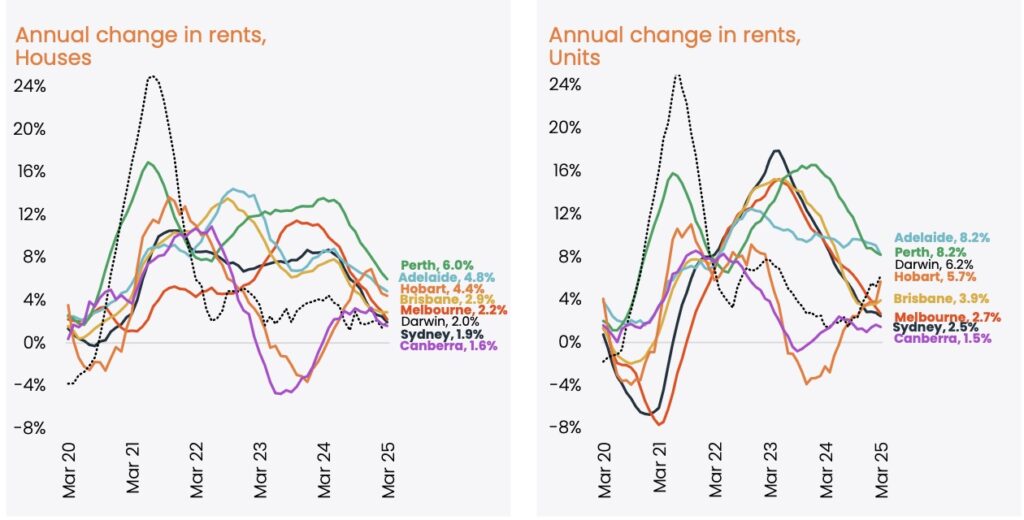

- Rental Market: Rent values also reached record highs, with the national rental index rising 0.6% in March. Gross rental yields increased to 3.53%, the highest level since 2019.

- Market Outlook: Improved sentiment following the February interest rate cut, easing monetary policy, cost-of-living relief, and income growth may support housing activity in the near term.

Dwelling Values

In March 2025, CoreLogic’s national Home Value Index (HVI) recorded a 0.4% increase, marking the second consecutive month of growth following a three-month decline of 0.5%.

The monthly rise was broad-based, with every capital city except Hobart recording a positive change. Hobart saw a 0.4% decline. Sydney and Melbourne recorded gains of 0.3% and 0.5%, respectively, while Darwin led with a 1.0% increase. Perth’s growth slowed to 0.2%, indicating a moderation after previous rapid gains.

The increase reflects improved sentiment following the February rate cut, alongside slight improvements in borrowing capacity and serviceability. While growth has returned, affordability constraints and supply challenges remain key factors in market conditions.

Rental Market

National rental values rose 0.6% in March, continuing a trend of consistent monthly increases, although the pace has slowed compared to the same time last year. The national vacancy rate remains low at 1.5%, well below the pre-COVID average of 3.3%.

Gross rental yields increased to 3.53%, the highest level since 2019. However, the rental market remains challenging for tenants, with affordability continuing to be a concern, particularly in key markets.

Interest Rates and Market Sentiment

The Reserve Bank of Australia (RBA) has continued its rate-cutting cycle, with the most recent cut in February 2025 helping to improve buyer sentiment and support housing market activity. While the financial impact of the rate cut was modest, it has positively influenced consumer confidence and helped sustain homebuyer demand.

This recovery in sentiment is evident, particularly in larger capital cities like Sydney and Melbourne, where values have shown a steady increase over the past two months. However, affordability remains a key challenge, particularly in high-demand markets where supply struggles to meet demand.

Despite the rate cuts, supply constraints and affordability pressures continue to shape market conditions.

Outlook

The Australian property market shows a cautiously optimistic outlook, with rising dwelling values and continued interest rate cuts. However, several factors require ongoing attention:

- Affordability Constraints: Despite the increases in property values, affordability remains stretched, particularly in cities like Sydney and Melbourne, where prices are rising without corresponding wage increases. Home loan serviceability is also at record highs.

- Rental Market Pressures: The rental market remains under pressure with rising rents and low vacancy rates. The ongoing imbalance between demand and supply emphasizes the need for policies to address housing affordability, though affordability issues persist.

Economic Conditions: Key economic indicators such as employment growth, consumer sentiment, and income growth will support housing activity. However, slower population growth and cautious lending policies could temper market growth. The rate-cutting cycle will likely continue, but broader economic challenges may constrain overall market recovery.

Although March 2025 brought positive developments, a balanced approach considering both opportunities and challenges will be essential for buyers, sellers, and investors navigating the evolving property landscape.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.