Welcome to our February 2025 Property Market Snapshot.

February in Review

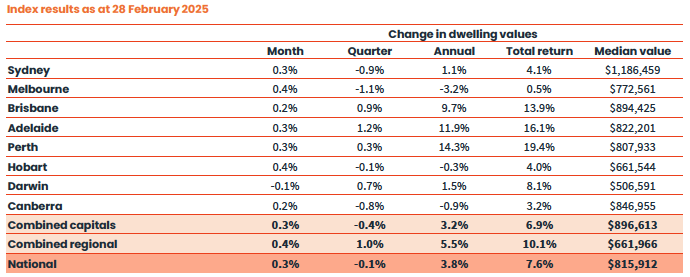

- The national Home Value Index (HVI) rose by 0.3% in February, marking a reversal of the three-month downturn.

- Melbourne and Hobart led the recovery, each posting a 0.4% increase in dwelling values.

- Rental affordability reached historic lows, with only 26% of Sydney rentals affordable for median-income households.

- The Reserve Bank of Australia implemented its first interest rate cut in five years, positively influencing buyer sentiment.

Dwelling Values

In February, CoreLogic’s national Home Value Index (HVI) recorded a 0.3% increase, effectively ending a brief three-month downturn that had seen values decline by 0.4%.

This modest rise is significant, signalling a potential turning point in the housing market.

Melbourne and Hobart were at the forefront of this recovery, each experiencing a 0.4% increase in dwelling values.

This uptick is particularly noteworthy for Melbourne, as it marks the end of a ten-month slide in property values.

These gains, though incremental, reflect a subtle yet positive shift in buyer sentiment, likely influenced by the Reserve Bank of Australia’s recent interest rate cut.

Despite these positive signs, the pace of growth varies across different markets. While some regions are experiencing a rebound, others continue to face challenges due to factors such as affordability constraints and varying levels of supply and demand. For instance, certain areas in Victoria, New South Wales, and Queensland have been identified as having higher mortgage arrears, indicating financial stress among homeowners.

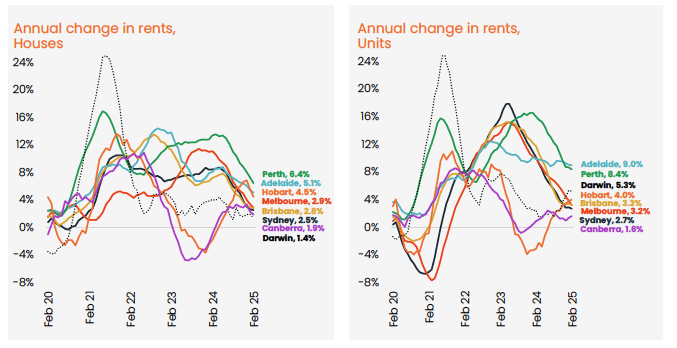

Rental Market

The rental market continues to grapple with significant challenges, particularly in terms of affordability. In Sydney, only 26% of rentals are affordable for households earning a median income, and a mere 2% are accessible for those earning $70,000 a year, marking the worst conditions on record.

Melbourne’s conditions are similarly strained, with half of the rentals affordable for typical households and less than 10% for low-income earners.

This widespread rental crisis underscores the urgent need for effective policy interventions to address the escalating affordability issues. The tight rental supply, coupled with high demand, continues to exert upward pressure on rents, making it increasingly challenging for many Australians to secure affordable housing.

Interest Rates and Market Sentiment

In a move that has positively influenced buyer sentiment, the Reserve Bank of Australia implemented its first interest rate cut in five years.

While the immediate financial impact of this cut may be modest, its psychological effect cannot be understated. Lower interest rates often boost consumer confidence, encouraging increased activity in the housing market.

This rate cut has likely contributed to the recent stabilisation in property values, as evidenced by the national HVI’s rise in February. However, it’s important to note that while lower interest rates can make borrowing more affordable, they do not fully mitigate other challenges such as affordability constraints and supply shortages.

Outlook

The recent uptick in dwelling values and the interest rate cut offer a cautiously optimistic outlook for the Australian property market. However, several factors warrant careful consideration:

- Affordability Constraints: Despite the recent stabilisation in property values, affordability remains a significant issue, particularly in major cities like Sydney and Melbourne. Continued price growth without corresponding wage increases could exacerbate this problem.

- Rental Market Pressures: The rental market’s ongoing challenges highlight the need for comprehensive strategies to increase affordable housing supply and alleviate pressure on renters.

- Economic Conditions: Broader economic indicators, including employment rates and consumer confidence, will play a crucial role in shaping the property market’s trajectory in the coming months.

While February 2025 has brought some positive developments to the Australian property market, a balanced approach that considers both opportunities and challenges is essential for stakeholders navigating this complex landscape.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.