Welcome to our January 2025 Property Market Snapshot

January at a Glance

The start of 2025 saw continued shifts in Australia’s property market, highlighting key trends across home values, rental growth, and market activity. Here’s an overview of the major developments:

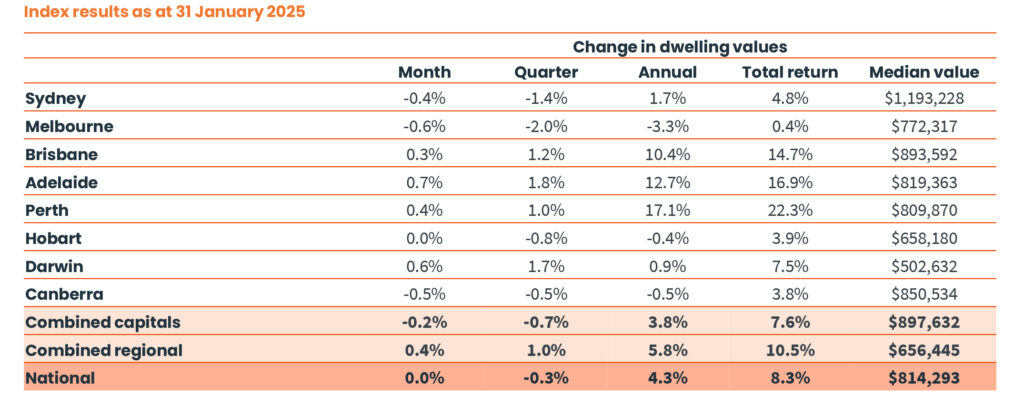

- National dwelling values held steady (-0.03%) as regional Australia hit record highs.

- Capital cities saw a -0.2% decline, while regional markets grew by 0.4%.

- Melbourne (-0.6%), ACT (-0.5%), and Sydney (-0.4%) recorded the sharpest declines.

- Perth and Brisbane showed continued growth, but at a slower pace.

- Annual national growth slowed to 4.3%, down from 9.7% in February 2024.

These trends indicate a shifting market landscape, as affordability challenges, economic uncertainty, and supply-demand imbalances shape buyer behaviour and home values in 2025.

Dwelling values

The Australian housing market remained stable in February, with national dwelling values declining slightly by -0.03%. The combined capital cities index fell by -0.2%, led by Melbourne (-0.6%), ACT (-0.5%), and Sydney (-0.4%). However, regional markets outperformed, with a 0.4% monthly increase, setting new record highs.

Adelaide was the strongest performer among the capitals, recording a 0.7% rise, while Perth and Brisbane continued to see growth but at a decelerating rate. According to CoreLogic’s Tim Lawless, “Perth is now recording a slower rate of growth than Brisbane and Adelaide over the rolling quarter. Growth in Perth home values was 7.1% in mid-2024 but has now eased to just 1.0% in the three months to January.”

Annual growth slowed to 4.3%, significantly down from its cyclical peak of 9.7% in early 2024. Sydney recorded an annual increase of 1.7%, its lowest since June 2023, while Melbourne (-3.3%) and Hobart (-0.4%) saw annual declines.

Rental market

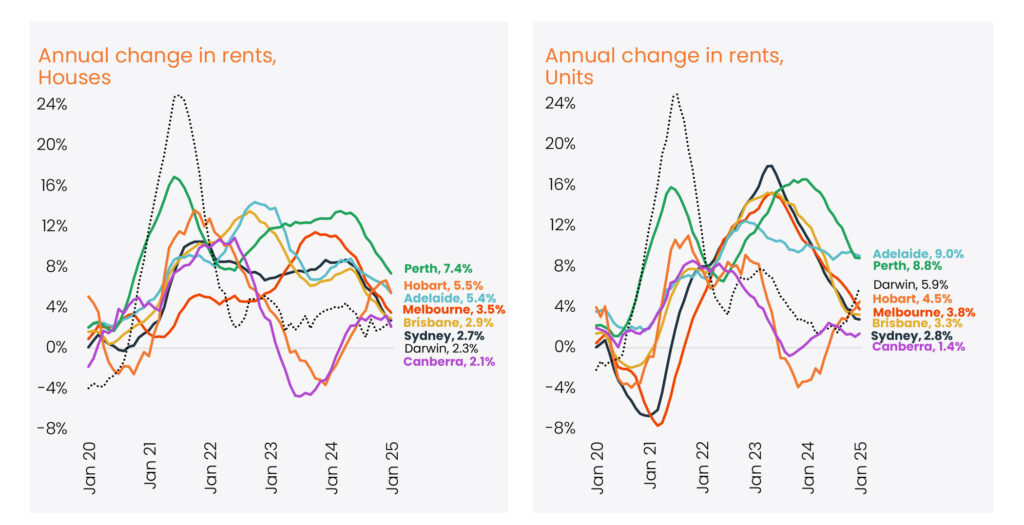

Rental price growth remained subdued, with a national increase of just 0.4% in February. Sydney (-0.4%) and Melbourne (-0.6%) experienced rental declines, while Perth saw the strongest growth among the capitals at 7.4%.

Gross rental yields remained relatively stable at 3.5% in the combined capitals and 4.4% in regional Australia. However, with rental growth easing, yields could come under pressure in the coming months. “Finally, renters are seeing some relief after extreme rental growth,” Lawless noted. “Over the past five years, capital city rents have surged by 37%.”

Outlook

Looking ahead, the housing market faces mixed signals. Interest rate cuts are widely anticipated in early 2025, which could support housing demand. However, affordability constraints, slower population growth, and ongoing economic uncertainty may temper any strong rebound.

Key trends to watch in 2025:

- Interest Rate Cuts: A potential rate reduction could improve borrowing capacity and support home prices.

- Affordability Challenges: High property prices continue to limit new buyers’ entry into the market.

- Stock Levels Rising: Increased listings in capital cities could lead to further softening in price growth.

- Regional Market Strength: Internal migration trends continue to favor regional housing markets.

- Slowing Rental Growth: Easing migration and larger household sizes may reduce rental demand.

While the outlook remains uncertain, any stabilisation in interest rates and inflation could provide a supportive environment for housing in 2025. However, affordability and supply constraints will remain critical factors to watch.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.