Welcome to our December 24 Property Market Snapshot

December at a glance

The final month of 2024 brought significant shifts to Australia’s property market, marking key turning points across housing values, rental growth, and market activity. Here’s an overview of the major trends:

- National home values fell by -0.1%, led by Sydney and Melbourne.

- Rental growth slowed to 0.1% monthly, with Perth leading at 9.7% annually.

- Higher stock and lower demand extended selling times and cut auction success.

These trends indicate a softening property market as affordability constraints, high borrowing costs, and increased supply weigh on buyer demand.

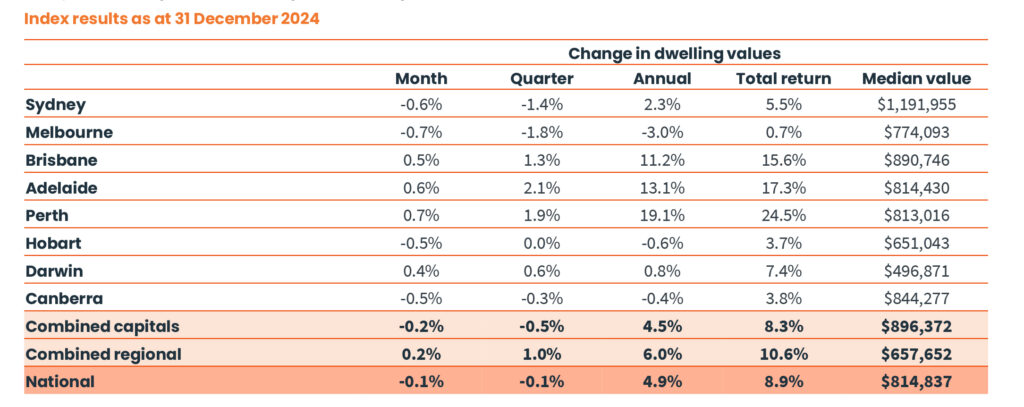

Dwelling values

The national property market showed signs of slowing down in December, as housing values declined by -0.1%. This marks the first drop in monthly values since February 2023. While declines were more pronounced in larger capital cities such as Sydney (-0.6%) and Melbourne (-0.7%), other cities demonstrated resilience. Adelaide and Perth both posted gains of +0.6% and +0.7%, respectively.

Regional markets were a bright spot, outperforming capital cities with a quarterly growth of 1.0%. The divergence between regional and metropolitan markets highlights the ongoing affordability challenges faced by buyers in larger cities, pushing demand to regional areas.

Rising stock levels and declining buyer demand contributed to subdued market activity, with auction clearance rates remaining consistently below 60%. These factors reflect a cooling in market sentiment as affordability constraints and higher interest rates continue to impact purchasing power.

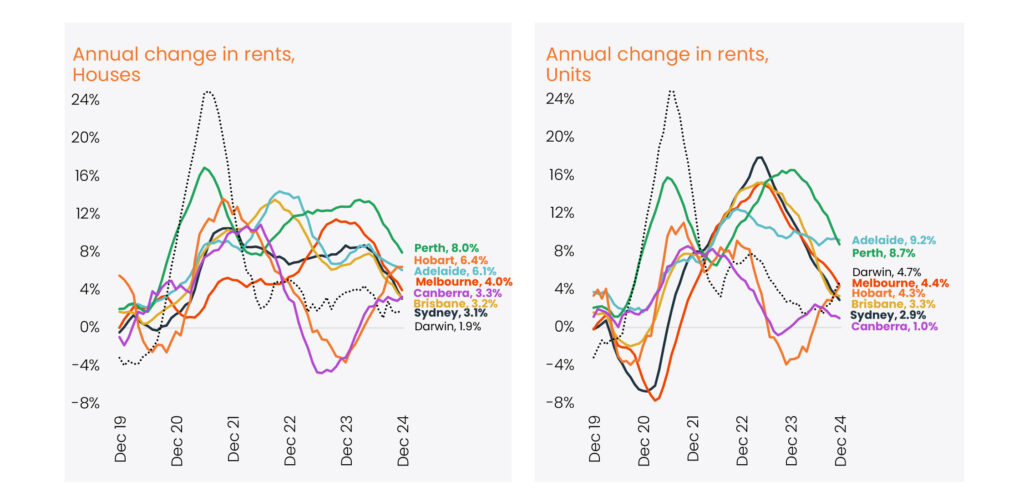

Rental market

The rental market experienced a marked slowdown in December, with national rents rising by just 0.1%. This brought annual rental growth to 4.8%, the lowest rate since 2021. The slowdown was consistent across most capital cities, with Perth emerging as a standout, boasting a 9.7% annual increase in unit rents.

Sydney and Melbourne, traditionally strong rental markets, experienced rental declines over the past three months, indicating a shift in demand dynamics. Gross rental yields remained stable at 3.69%, reflecting the balance between rental income and subdued property prices.

The softening rental market can be attributed to factors such as easing migration, higher household sizes, and persistent rental affordability challenges. With the median rent consuming a third of household income, affordability continues to be a critical issue heading into 2025.

Outlook

The Australian property market is expected to face a mixed outlook as we move into 2025. Key trends and factors likely to shape the market include:

- Interest Rate Cuts: Anticipated interest rate reductions could provide relief to buyers, improving borrowing capacity and reducing mortgage repayments. However, any impact on housing values is expected to be gradual.

- Easing Inflation: Lower inflationary pressures may support improved buyer confidence and household budgets, but affordability challenges are likely to persist.

- Higher Stock Levels: Increased stock availability may continue to weigh on property prices, particularly in larger capitals where supply-demand imbalances are more evident.

- Rental Affordability Challenges: Stabilising rents may provide some relief to tenants, but affordability remains a key concern, with many households struggling to manage costs.

- Regional Market Growth: Regional areas are expected to remain attractive for buyers seeking affordable housing options, particularly as affordability in larger cities continues to constrain demand.

While 2024 concluded on a softer note, the potential for stabilisation or modest growth in certain segments exists, particularly if economic conditions improve and demand from buyers rebounds. However, affordability and household debt levels remain critical factors to watch.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.