Welcome to our September 24 Property Market Snapshot.

September at a glance

-

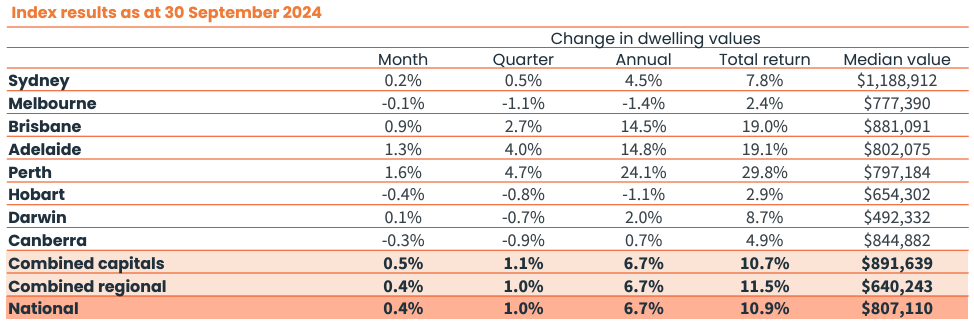

In September national home values rose by 0.4%, marking the 20th consecutive month of growth.

- Nationally, housing values rose 1.0% in the September quarter – the lowest rise in the national Home Value Index (HVI) over a rolling three-month period since March 2023.

-

Melbourne, Canberra, Hobart and Darwin recorded a fall in dwelling values through the September quarter.

-

Sydney home values did continue to rise however the 0.5% increase through the September quarter was the lowest growth result since the quarter ending February 2023.

Dwelling values

Home values in Australia crept higher nationally as growth momentum continued to dissipate. In September, national dwelling values increased by 0.4%. This was broadly in line with the monthly change of 0.3% in July and August.

Reflecting varied housing conditions, four capital cities experienced declines in dwelling values during the September quarter. Melbourne led the trend with a drop of 1.1%. Canberra, Hobart and Darwin also recorded declines.

Meanwhile, Sydney home values continued to rise, though the 0.5% increase in the September quarter was the slowest growth since the three months ending in February 2023, when values fell by 0.3%.

The slowdown in growth coincides with an increasing number of homeowners looking to sell. The influx of new listings on the market is currently 3.2% higher than last year and 8.8% above the five-year average for this time of year. “

Source: CoreLogic Hedonic Home Value Index, 30 September 2024.

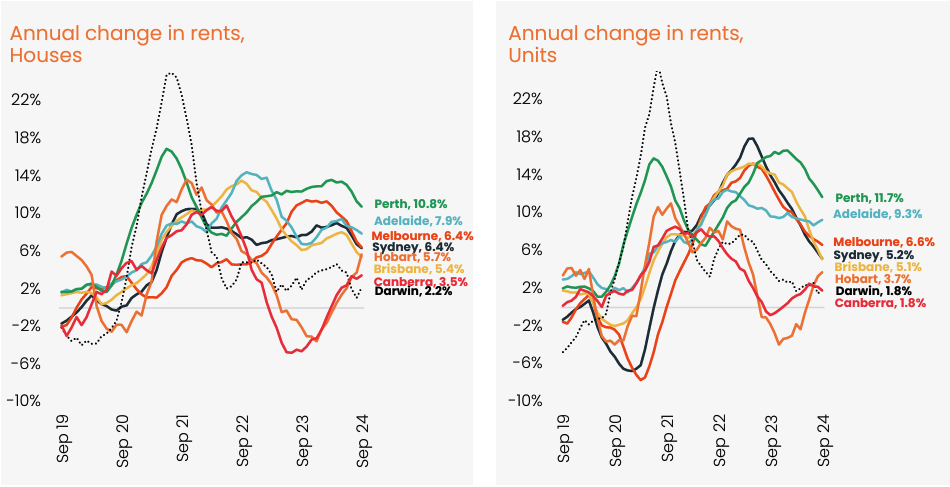

Rental market

The September quarter saw the smallest change over a rolling three-month period in four years, with a national rental index increase of just 0.1%. This is likely to be the product of easing net overseas migration in addition to rental affordability pressures forcing a demand restructure.

As rental growth shows a more noticeable slowdown compared to value growth, five straight months where the national home value index has risen more on a monthly basis than the rental index have been observed. This trend is exerting renewed downward pressure on rental yields.

The gross rental yield has reduced to 3.68% nationally – the lowest since last December.

Source: CoreLogic Hedonic Home Value Index 30 September 2024.

Outlook

The immediate outlook in the housing market is for more growth in housing values, at least at the macro level, however the slow loss of momentum looks likely to continue with increasing diversity across the cities and regions.

Sentiment appears to be improving due to a slowing in inflation, tight labour markets and a consensus that interest rates might be cut. Households are seeing the benefit from tax cuts and energy rebates which could assist to lift sentiment and borrowing capacity. Meanwhile, real income growth would be supported by a further slowing of inflation.

Buyers should have some additional leverage at the negotiation table with a further rise in real estate listings and a good chance listing numbers will rise further through spring and early summer.

Demand and supply of rentals look to have rebalanced with rental growth appearing to have peaked.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.