Welcome to our August 24 Property Market Snapshot.

August at a glance

-

In August national home values rose by 0.5%, marking the 19th consecutive month of growth.

-

Quarterly growth has halved compared to the previous year, with affordability issues and high interest rates contributing to the slowdown.

-

Perth and Adelaide led monthly growth with 2.0% and 1.4% increases, respectively, and now have higher median dwelling values than Melbourne.

- National rent growth has slowed significantly, with a flat CoreLogic rent index in August and annual growth dropping to 7.2%, the lowest since May 2021.

-

Rent yields are changing, with Brisbane and Adelaide’s yields now on par with Melbourne, while Perth’s yields have declined.

Dwelling values

Australian housing market growth has decelerated through the winter months. In August, national home values increased by 0.5%. This marks the 19th consecutive month of growth, but this is a slowdown compared to previous rates. Quarterly growth has halved from last year’s figures, reflecting a broader trend of easing demand.

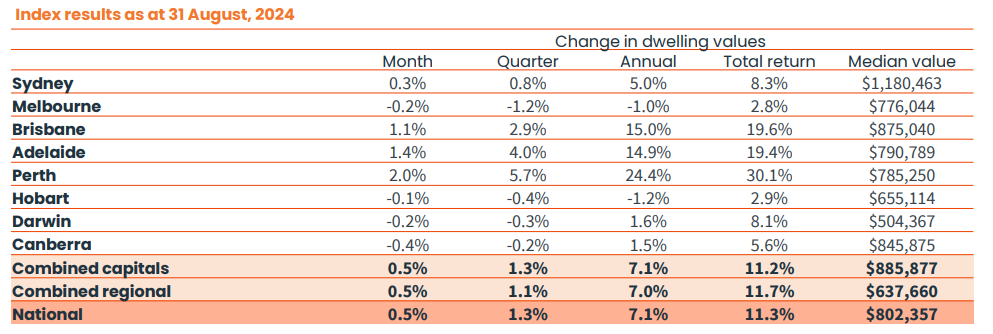

Regional disparities are significant. Melbourne’s housing supply is about 25% above the five-year average. While Perth and Adelaide have seen their listings drop by over 40%. Perth led the monthly growth with a 2.0% increase, followed by Adelaide at 1.4%, and Brisbane at 1.1%. In contrast, Sydney saw a modest 0.3% increase, and four capitals—Canberra, Melbourne, Darwin, and Hobart—experienced declines.

The slowdown is more pronounced in some areas. For example, Brisbane’s quarterly growth rate fell from 4.1% in May to 2.9% in August. This suggests a cooling demand amid rising affordability concerns.

Despite this, more affordable housing segments are performing better. The lower quartile of the market saw a 2.7% rise in values over the past three months. This compared to just 0.3% for the upper quartile. Perth and Adelaide have surpassed Melbourne in median dwelling values, marking a significant shift. For the first time since February 2015, Perth’s median value is higher than Melbourne’s. Adelaide’s median is now also above Melbourne’s.

Source: CoreLogic Hedonic Home Value Index, 2 September 2024.

Rental market

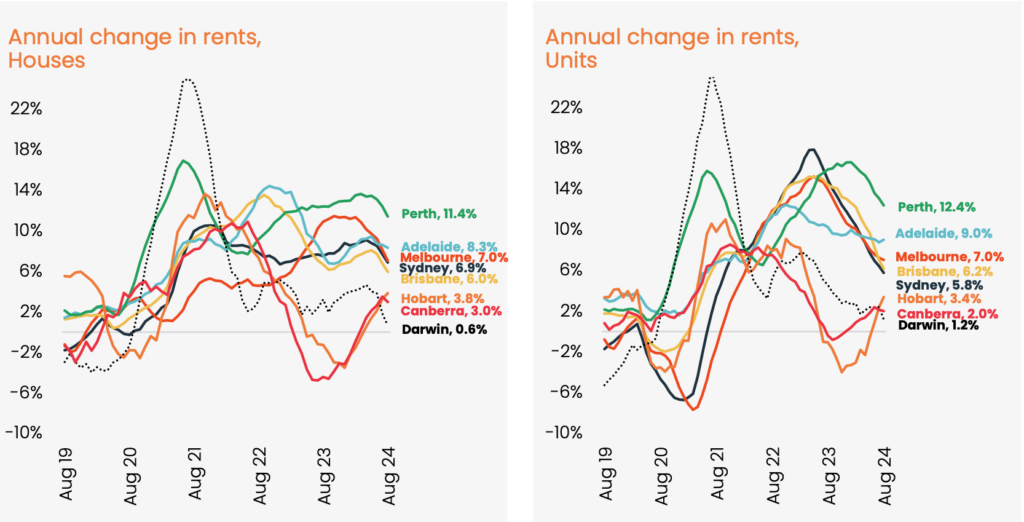

Relief for renters is on the horizon as rent growth shows signs of easing. The CoreLogic hedonic rent index remained stable for the second consecutive month in August. Sydney has experienced a second straight month of declining rents. Annual rent growth has slowed to 7.2%, the lowest since May 2021, with most capital cities seeing a deceleration in rent increases, except Hobart.

Driving this slowdown is a drop in demand, with lower net overseas migration and fewer international students. A slight increase in average household sizes, suggests a return to shared or multi-generational housing due to high rents. On the supply side, while investor loans increased by 10.7% over the past year, challenges in the construction sector continue to limit new housing completions.

Rent yield trends are also shifting, with Brisbane and Adelaide’s yields now on par with Melbourne at 3.7%, and Perth’s yields decreasing from 4.8% to 4.3%. This yield compression, common during periods of rising property values, might reduce investor interest in rapidly growing markets, though some investors remain focused on long-term opportunities.

Source: CoreLogic Hedonic Home Value Index 2 September 2024.

Outlook

Looking ahead, the national housing market is projected to experience modest value increases through the end of 2024. Although growth has slowed, housing values remain supported by a persistent shortage of new supply. This has been further strained by ongoing issues in the residential construction sector. The RBA’s recent Statement on Monetary Policy highlighted a shortage of finishing trades and increased competition for labor due to public infrastructure projects, particularly in the multi-unit sector.

Buyer activity has decreased due to high living costs, and many sellers may choose to wait if they don’t receive their desired price. While the tight job market is aiding mortgage servicing, any unexpected relaxation in labor market conditions could impact housing values.

The substantial gap between the affordable purchase price for median-income households ($500,000) and the actual median dwelling value ($802,000) has likely narrowed the buyer pool to those with higher incomes. As spring approaches, sellers should be aware of local market conditions. This includes the number of properties for sale, time on the market, auction clearance rates, and price trends,

CLICK HERE TO DOWNLOAD THE FULL REPORT

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.