Welcome to our July 24 Property Market Snapshot.

July at a glance

-

In July, national home values rose by 0.5%, marking the 18th consecutive month of growth.

-

Rental growth has slowed, with CoreLogic’s hedonic rental index increasing by only 0.1% in July – the smallest rise since August 2020.

-

The ongoing imbalance between housing supply and demand is expected to support housing prices through the second half of the year, despite a slight increase in real estate listings.

-

Investor lending is up 24.8% nationally and now comprises 37.1% of mortgage demand, with Western Australia seeing a 53% increase in investor lending.

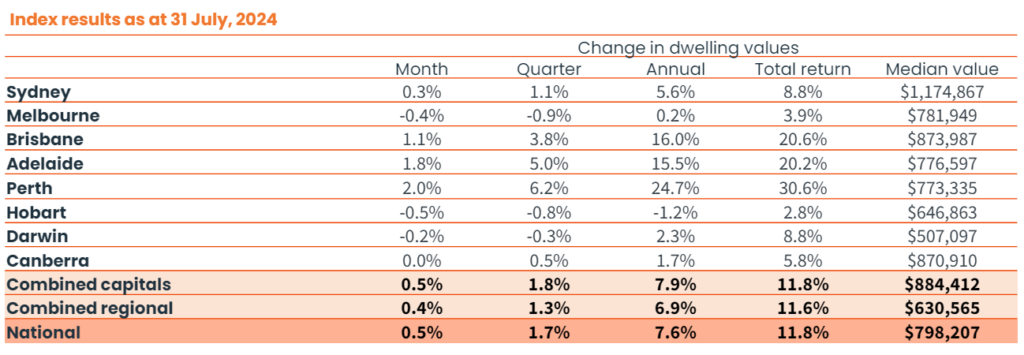

Dwelling values

In July, national home values experienced a 0.5% increase, marking the 18th consecutive month of growth. This follows a significant decline of 7.5% from May 2022 to January 2023, resulting in an overall gain of 13.5% since that low point. Although the overall trend remains positive, momentum is slowing. Three capitals, Melbourne, Hobart and Darwin, reported declines over the past three months. Sydney’s growth has notably decreased to 1.1%, down from 5.0% during the same period last year.

Conversely, mid-sized capitals like Perth (6.2%) and Adelaide (5.0%) are showing strong growth. This is attributed to a lower supply of housing compared to typical levels.

Affordability challenges are steering demand towards lower-priced homes. Lower quartile values have risen by 3.3% in the past three months, while upper quartile values saw only a 0.8% increase. Regional housing values are lagging behind capital cities, with a modest increase of 1.3%. Additionally, units are now appreciating faster than houses in most capitals. Darwin and the ACT are exceptions though. This is due to affordability pressures and heightened activity from investors and first-time buyers continuing to shape the market.

Source: CoreLogic Hedonic Home Value Index, 1 August 2024.

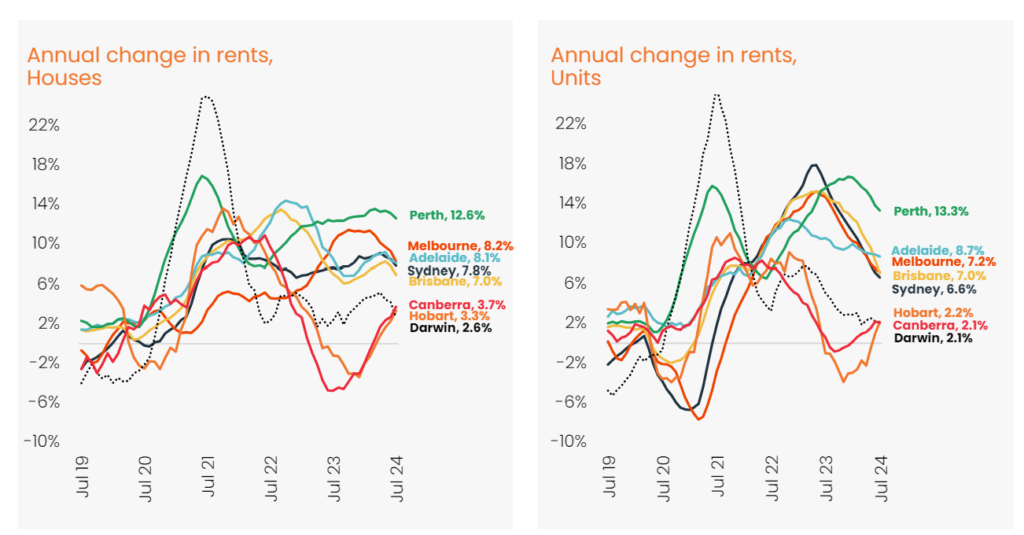

Rental market

In July, CoreLogic’s hedonic rental index registered a modest increase of just 0.1%, the smallest monthly rise since August 2020. Notably, both Sydney and Brisbane saw their rents decline by 0.1%, while Hobart experienced a 0.3% drop, marking the first monthly decreases in these cities since 2020. A pronounced slowdown in rental growth, particularly in the unit sector, has significantly impacted overall rental trends, with Sydney’s annual unit rent growth plummeting from 17.9% last May to just 6.6%. Similarly, Melbourne and Brisbane recorded a decline of more than 8 percentage points in their annual growth rates.

Despite this deceleration, Sydney’s unit rents still rose by 6.6% over the past year, more than double the pre-COVID average of 2.7%. This trend aligns with the peak in net overseas migration observed in early 2023, primarily from temporary visa holders, who typically seek rental accommodations in inner-city areas.

House rents are also experiencing a slowdown in most cities, although they remain above pre-COVID growth rates. With property value increases outpacing rental growth, downward pressure on gross rental yields could emerge. The gap between investor mortgage rates and gross rental yields has widened considerably since April 2022, growing from a mere 1 basis point difference to 294 basis points by July, suggesting that opportunities for positive cash flow for investors are becoming increasingly limited.

Source: CoreLogic Hedonic Home Value Index, 1 August 2024.

Outlook

The ongoing imbalance between housing supply and demand is likely to sustain housing prices through the second half of the year. During autumn and winter, real estate listings have increased slightly above average, testing buyer demand. While overall demand has managed to absorb this higher supply, specific weaknesses are becoming apparent. In particular Hobart and Melbourne, where listings significantly exceed average levels. Between April and July, around 125,000 sales occurred across Australia. This was slightly higher than the 121,000 new listings added, indicating that buyers still outnumber sellers.

Despite an increase in available homes, the supply of newly constructed properties remains inadequate relative to population growth.

Investor activity is on the rise. Lending for investment purposes increasing by 24.8% nationally, now accounting for 37.1% of mortgage demand. In Western Australia, investor lending has surged by 53%, aligning with a 23.9% increase in home values. However, many investors might be facing cash flow challenges, as rental yields are currently lower than mortgage rates.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.