Welcome to our June 24 Property Market Snapshot.

June at a glance

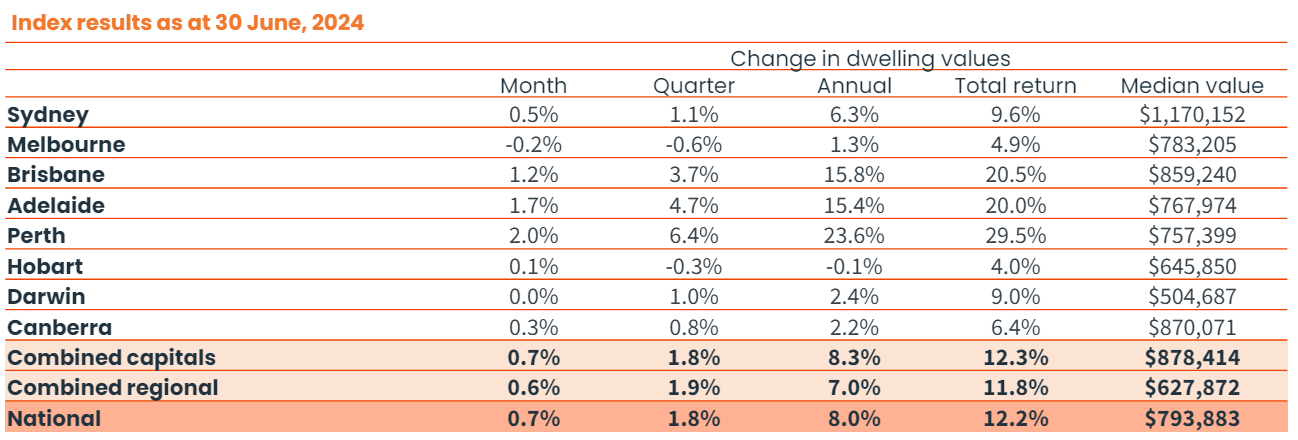

- June saw home values increase by a further 0.7% increase, the 17th consecutive month of growth.

- In the last financial year housing values grew by 8.0%.

- The national rental index saw a monthly increase of 0.4%, the lowest since September of the previous year.

Dwelling values

In the last financial year (2023-24), Australia’s housing market saw dwelling values growing by 8.0%. This increase translates to a substantial $59,000 rise in the median dwelling value, which now stands at $794,000.

This turnaround comes after a challenging previous year, FY2022-23, when national dwelling values declined by 2.0%. The recovery was driven by strong performances across most regions, particularly in mid-sized capitals like Perth, Adelaide and Brisbane, where values grew impressively over the year.

Despite facing obstacles such as high interest rates, rising living costs and tight credit conditions, the housing market demonstrated resilience. This resilience was supported by limited housing supply, which continued to push property values upwards.

Regional markets also experienced robust growth, with Regional WA leading with a significant 16.6% increase in dwelling values over the year. However, Melbourne, regional Victoria and Hobart saw modest declines or stagnant growth in property values.

The market also exhibited considerable variation in housing availability. Strong markets like Perth, Adelaide and Brisbane faced severe shortages of homes for sale compared to historical averages, while Melbourne and Hobart saw elevated listings.

Rental market

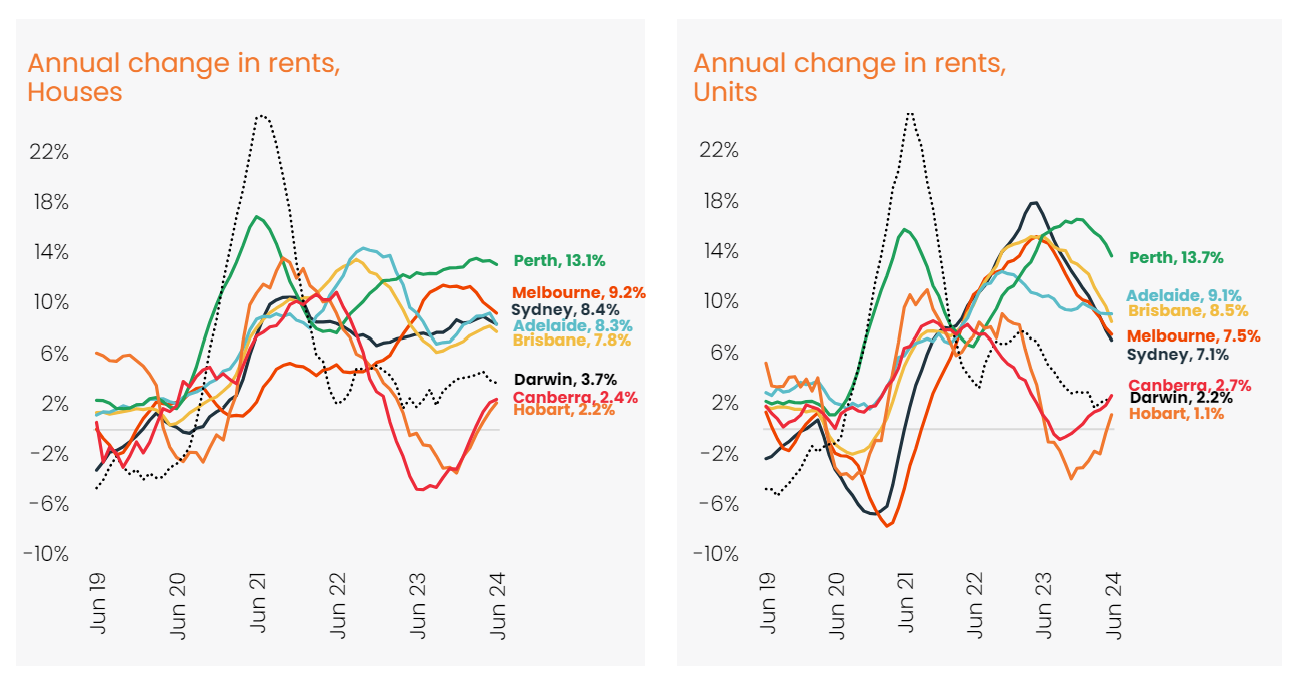

Rental growth in Australia has shown signs of easing but remains notably strong. According to CoreLogic, the national rental index saw a monthly increase of 0.4%, the lowest since September of the previous year. Annually, rents have risen by 8.2%, marking a slowdown from higher levels seen in recent months.

The most significant slowdown in rental growth is evident in the unit markets of Australia’s largest cities. Sydney’s annual rental growth for units decreased by 10 percentage points to 7.1%, while Melbourne and Brisbane also saw declines to 7.5% and 8.5%, respectively.

Several factors contribute to this moderation. The reduction in overseas migration, which has been pivotal for inner-city rental markets, is one. Seasonal patterns, such as increased demand from students in the first quarter, also influence these trends.

Affordability concerns are another factor affecting the unit sector, with rents rising by 22% over the past two years compared to a 16% increase in house rents. CoreLogic’s affordability metrics show that the median household income now allocates 32.2% of its gross annual income to rental payments, the highest on record.

Despite the slowdown in some markets, rental prices continue to rise faster than the long-term average across most regions and housing types. Prior to the pandemic, the average annual rental growth rate over a decade was just 2.0%.

Gross rental yields have stabilised around 3.5% in major cities and 4.4% in regional areas since early 2023.

Source: CoreLogic Hedonic Home Value Index, 1 July 2024.

Source: CoreLogic Hedonic Home Value Index, 1 July 2024.

Outlook

Overall, the Australian housing market in FY2023-24 showcased resilience and strong recovery, benefiting homeowners with substantial increases in property wealth, particularly in regions with buoyant market conditions.

Recent trends indicate an increase in new property listings, suggesting heightened seller activity. These listings are quickly snapped up, leaving overall advertised supply levels nearly 18% below the previous five-year average nationwide.

Looking forward, the consensus is that home values will likely continue to rise in the short term. Significant increases in new housing supply are unlikely in the near future due to low approval rates and ongoing construction challenges. As long as housing supply remains constrained relative to demand, upward pressure on home values is expected to persist.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.