Welcome to our March 24 Property Market Snapshot.

March at a glance

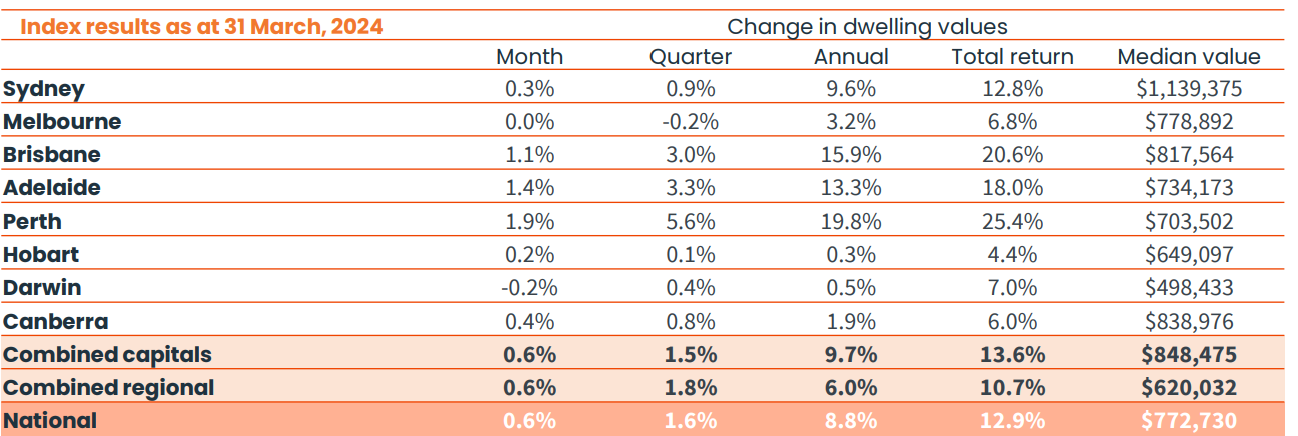

- In March, Home Values saw a 1.6% increase, translating to an approximate $12,000 rise in dwelling values.

- Most major cities experienced a rise in dwelling values, with Perth leading at 1.9%, followed by Adelaide and Brisbane. Melbourne was the only city with a negative quarterly movement (-0.2%).

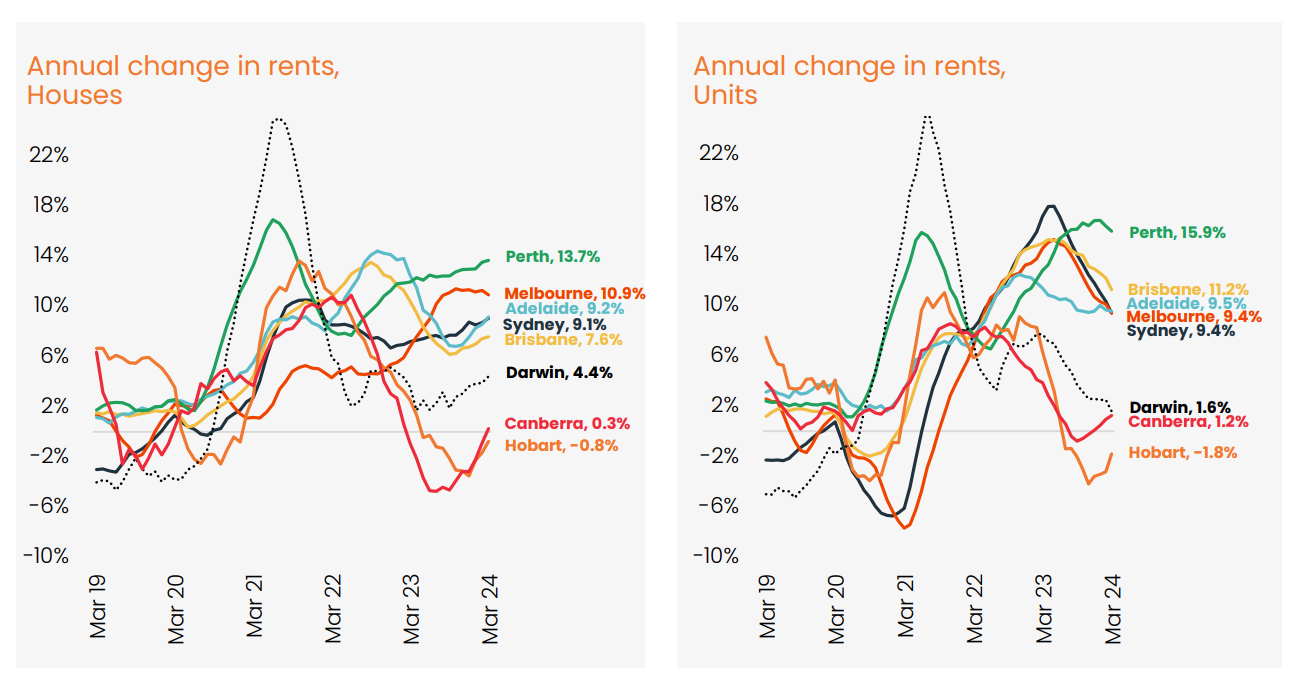

- Unit rents surpassed house rents in the combined capitals, rising by 2.9% compared to 2.7% for houses.

Dwelling values

During March, home values nationally saw a 1.6% increase, translating to an approximate $12,000 rise in dwelling values. This marks the 14th consecutive month of housing value growth. Since the downturn between April 2022 and January 2023, the national Home Value Index has surged by 10.2%, consistently reaching new record highs since November last year.

Most major cities experienced a rise in dwelling values, with Perth leading at 1.9%, followed by Adelaide and Brisbane. Melbourne was the only city to show a negative quarterly movement (-0.2%).

The strongest growth conditions have shifted towards lower-priced properties in most major cities. Regional housing markets also experienced a rise in values, with regional Victoria showing the weakest growth conditions.

Home sales in the first quarter were estimated to be 9.5% higher than the same period last year.

Source: CoreLogic Hedonic Home Value Index, 2 April 2024.

Rental market

During the month, the national rental index surged by 2.8%, marking the most rapid quarterly growth since May 2022. While some of this growth can be attributed to seasonal patterns, the overall trend in rental growth has been on the rise since October last year, suggesting a sustained acceleration rather than just seasonal fluctuations.

Unit rents outpaced house rents in the combined capitals, rising by 2.9% compared to 2.7% for houses in the March quarter. However, there’s a gradual convergence in the growth rates between house and unit rentals.

With rents increasing faster than housing values once again, there’s renewed upward pressure on rental yields. Nationally, the gross rental yield reached 3.75%, its highest level since October 2019. Melbourne particularly stands out with a significant rise in gross rental yields, attributed to a decline in dwelling values coupled with a substantial surge in rents over the past two years.

Source: CoreLogic Hedonic Home Value Index, 2 April 2024.

Outlook

Despite facing obstacles such as high interest rates and living expenses, housing markets are displaying resilience, with widespread increases in both property values and rents observed across urban and regional areas. There’s a positive outlook for housing values, driven by expectations of forthcoming interest rate reductions, which could enhance borrowing capacity and consumer confidence.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Source: CoreLogic Hedonic Home Value Index, 2 April 2024.

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.