Welcome to our February 24 Property Market Snapshot.

February at a glance

- Australia’s housing marketing saw a 0.6% rise in February 2024, marking the 13th consecutive month of increasing values.

- We are seeing early signs of a boost to housing confidence as inflation eases and expectations for rate cuts later on this year firm up.

- Auction clearance rates have seen an increase through February, with an average of 60% overall through the month.

- Growth rates in major cities have levelled out, with Melbourne emerging from a three month slump to record a 0.1% rise in February. Sydney has also moved back into positive territory.

Dwelling values

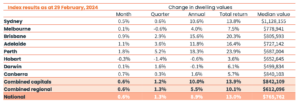

Australia’s housing market maintained its upward trajectory in February 2024, reporting a 0.6% increase in Corelogic’s national Home Value Index (HVI). This marks the 13th consecutive month of rising values. Each of the capital cities and regional areas recorded a lift in values over the month – except Hobart where the market fell 0.03%. Smaller regional cities have seen seen a subtle increase recording an increase of above 1%. Perth has continued to stand out with a rapid rate of capital gains, with a 1.8% increase in February and 18.3% increase over the past year. Median dwelling values in the location continue to remain affordable at just under $687,004.

The regional housing market continued to outpace the combined capitals, experiencing a 1.3% rise over the quarter. The combined capitals saw an increase of 0.2%. Larger capital cities such as Sydney and Melbourne continue to see a slowdown in growth conditions.

Source: CoreLogic Hedonic Home Value Index, 1 March 2024.

Rental market

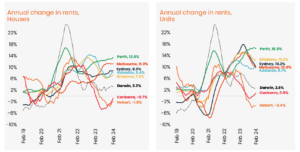

In February, there has been a growth in rental values rising to 0.9%, the highest reading since March last year. This re-acceleration also saw the rolling quarterly change in rents rise to 2.4%, the highest since May last year. The pick up in rents is mostly a seasonal phenomenon, we with the first quarter showing an accelerating trend due to demand from students and new year leases beginning.

Perth continues to show a substantially faster rate of rental growth that is showing little evidence of slowing down. The underlying factors affecting the home value results are at play here, with demand substantially outweighing supply, keeping rental growth well above average levels. During the rolling quarter the areas leading the rental growth trend were Regional NT, with gross yields sitting at 7.1%.

The detached housing sector is responsible for the acceleration in rental trends, with annual rental growth in houses trending higher since October last year. The trend in unit rents is moving in the opposite direction, easing up from a recent peak in April last year where rents were up 14%. Annual growth in unit rents since then has been reduced to 9.6%.

Source: CoreLogic Hedonic Home Value Index, 1 February 2024.

Outlook

The outlook for values has improved a little since the end of last year, with a subtle re-acceleration in the pace of value gains through the first two months of the year.

Indicators of a positive shift in market conditions go beyond a lift in value growth, including a rise in consumer sentiment, lower than forecast inflation and a growing consensus that interest rates will reduce later this year.

An improvement in consumer spirits has historically played out positively for housing activity, with higher sentiment generally accompanied by a lift in home sales and vice versa. Westpac and the Melbourne Institute reported a 6.2% lift in the consumer sentiment index for February, taking the reading to the highest level since June 2022.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.