Welcome to our December 23 Property Market Snapshot.

December at a glance

- In December, the national Home Value Index (HVI) recorded an 8.1% increase.

- Monthly home value gains ended the year with a modest 0.4% rise in December, representing the smallest monthly increase since the upward trend began in February.

- Capital cities displayed varying growth rates, with Perth, Adelaide, and Brisbane maintaining consistent increases, while Melbourne and Sydney experienced a slowdown.

Dwelling values

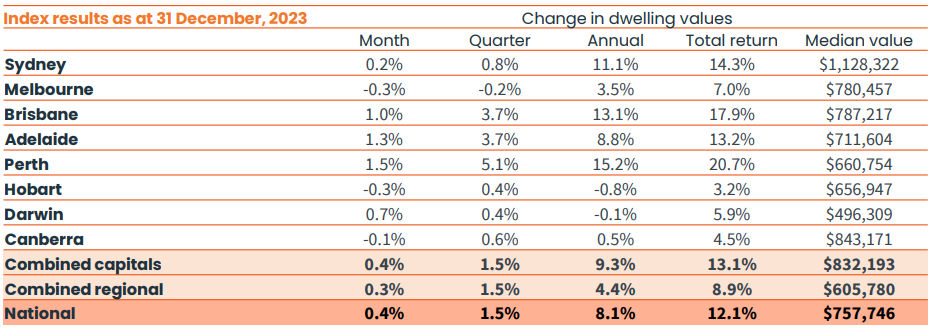

In December, the national Home Value Index (HVI) witnessed a 8.1% increase, marking a notable recovery from the 4.9% decline in 2022, though falling short of the 24.5% surge seen in 2021. The year concluded with a modest 0.4% rise in home values in December, representing the smallest monthly gain since the upward trend began in February. Various market factors, including interest rate hikes, cost of living pressures, affordability challenges, rising advertised stock levels, and low consumer sentiment, played a role in shaping these dynamics.

Despite the overall annual increase, significant diversity was observed across regions. Housing values ranged from a 15.2% surge in Perth to a 1.6% fall in regional Victoria. Capital cities displayed varying growth rates, with consistent increases in Perth, Adelaide, and Brisbane, contrasting with a slowdown in Melbourne and Sydney. Smaller cities like Hobart and Darwin recorded declines.

The differing growth rates across capital cities were attributed to demand and supply factors. Cities facing fewer affordability challenges and lower advertised supply levels, such as Perth, Adelaide, and Brisbane, exhibited higher growth. Conversely, cities with higher advertised supply and lower home sales, like Melbourne and Sydney, experienced lower or negative growth.

On the whole, capital cities outperformed regional areas, with dwelling values up 9.3% across the combined capital cities index, more than double the 4.4% rise in the combined regional index. This marked a shift from the initial COVID trend, where regional markets experienced higher demand due to internal migration. Regional migration trends normalised in 2023, and the substantial capital gains from 2020 to 2022 led to reduced affordability in many regional markets.

Despite the overall rise in housing values, five of the eight capitals still recorded values below their peak at the end of 2023. Sydney, Melbourne, ACT, Hobart, and Darwin all reported values below their respective peak levels, highlighting variations in market performance across different cities.

Source: CoreLogic Hedonic Home Value Index, 2 January 2024.

Rental market

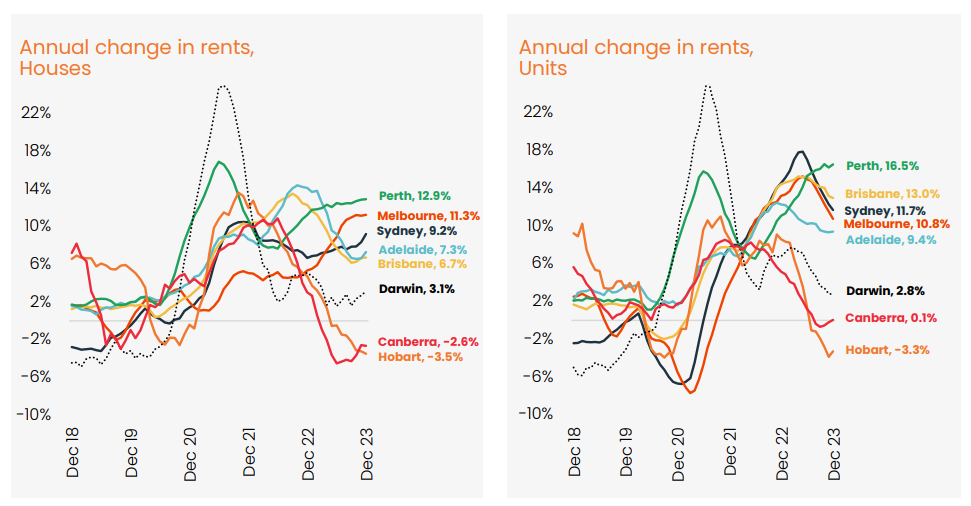

In 2023, national rents experienced an 8.3% increase, reflecting a slowdown from the 9.5% rise in the preceding year and the 9.6% surge in 2021. Despite this deceleration, the growth surpassed more than four times the pre-COVID decade average of 2.0% per annum. This translates to an average increase of approximately $46 per week in dwelling rents based on the median rental value.

Diversity is evident across rental markets in 2023, encompassing various housing types and geographical locations. While unit rents demonstrated a faster growth rate at 10.2% compared to house rents at 7.5%, there is an overall deceleration in most unit markets. Factors such as a potential decline in net overseas migration and renters reaching their affordability limits may contribute to this trend.

Perth stands out as an exception in rental growth, leading the nation with substantial increases in both house and unit rents (12.9% and 16.5%, respectively). In contrast, Hobart and Canberra witnessed a decline in rents over the year.

In combined regional areas, rental growth slowed to 4.3% in 2023, marking the smallest calendar year rise since before the pandemic. This deceleration is attributed to normalised regional migration trends, resulting in reduced rental demand and easing growth on inherently higher rent values.

Source: CoreLogic Hedonic Home Value Index, 2 January 2024.

Outlook

Anticipations for the housing market in early 2024 suggest a more subdued trend, potentially characterised by two distinct phases. The initial part of the year may pose challenges for the growth of dwelling values, given the combined impact of elevated interest rates and a weakened economic backdrop. This trend became evident towards the close of 2023, with Melbourne experiencing a decline in home values in November and December, and monthly growth in Sydney moderating to 0.2%. Even in Brisbane, where a robust capital growth trend was observed, the pace eased from 1.5% in October to 1.0% in the final month of the year.

The trajectory of interest rates in 2024 will be instrumental in shaping housing trends. While the possibility of another rate hike is not ruled out, factors such as lower inflation and an economic slowdown suggest that a rate cut is becoming increasingly improbable. Financial markets were pricing in a 25 basis point rate cut by June 2024, and a potential reduction in the cash rate could stimulate demand, contributing to a more positive housing trend in the latter part of the year.

Despite the potential for lower interest rates, policymakers remain cautious, emphasising that credit availability may remain relatively constrained. Housing affordability emerges as a significant concern, as the latest report indicates a worsening trend across various metrics. Policy responses are expected to be varied, with a spotlight on measures addressing the supply side in 2024. The Housing Australia Future Fund (HAFF) is poised to make a positive contribution to affordable housing supply in the second half of the year.

However, the undersupply of newly built housing is likely to provide support to housing prices, and the delayed impact of record-high overseas migration in the previous year is anticipated to influence purchasing activity in the years to come. In summary, the outlook for 2024 suggests a nuanced housing market influenced by interest rates, affordability challenges, and dynamics on the supply side.

In terms of the rental market, given the absence of a substantial increase in rental supply thus far, it is probable that rent growth will continue to surpass the average in 2024. Nevertheless, there is a potential for a further deceleration in rental growth due to affordability challenges prompting structural shifts in rental demand, including potential shifts in household size and an increase in multi-generational households.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.