Welcome to our October 23 Property Market Snapshot.

October at a glance

- National Home Value Index (HVI) rose by 0.9% in October, nearing the historic high from April.

- Capital city housing values have slowed, up 2.6% over the past three months due to higher stock levels and affordability concerns.

- Perth, Brisbane, and Adelaide led dwelling value growth, with three capitals exceeding 10% growth in the first 10 months of the year.

- Rental vacancies hit record lows in October, with combined capital cities at 0.9% and combined regional markets at 1.2%, but rent growth has slowed and diversified.

Dwelling values

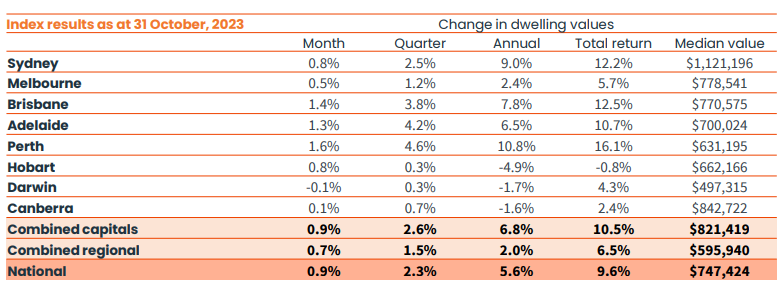

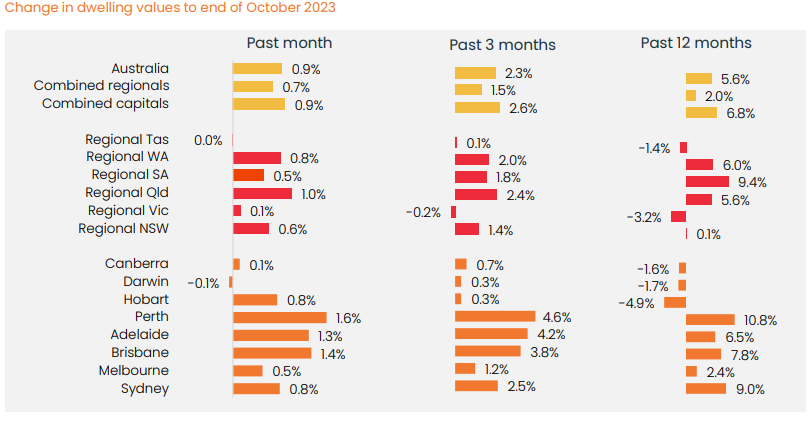

In October, the national Home Value Index (HVI) reported a 0.9% increase, marking another consecutive month of growth. Since reaching a low point in January, the national HVI has risen by 7.6%, leaving it just 0.5% below the historic high recorded in April of the previous year.

While housing values are consistently increasing in most capital cities, there has been a slowdown in the quarterly pace of growth, attributed to higher stock levels and stretched affordability. The three months ending in June 2023 saw capital city home values rise by 3.7%, but this growth has since decreased to 2.6% over the three months ending in October. The trend is expected to continue as new listings enter the market amid high interest rates and low sentiment.

Dwelling values rose in most capital cities except for Darwin, with Perth, Brisbane, and Adelaide outperforming the others. Three capitals, Sydney, Perth, and Brisbane, have seen dwelling values rise by more than 10% in the first 10 months of the year. Brisbane’s housing values posted a nominal recovery in October, erasing the previous drop to reach a new record high, as did Perth and Adelaide after earlier downturns.

Source: CoreLogic Hedonic Home Value Index, 1 November 2023.

Regional markets continue to lag behind capital cities in terms of growth, with the combined regional index rising by 0.7% in October compared to the 0.9% rise in combined capitals. Stronger conditions are observed in Regional Queensland, Western Australia, and South Australia, with these regions reaching record highs in October.

However, some regional areas have experienced a drop in home values over the past three months, with most located in Regional Victoria and Regional New South Wales. Regional Victoria remains the softest of the rest-of-state regions, with housing values holding nearly flat and remaining below the May 2022 peak.

Source: CoreLogic Hedonic Home Value Index, 1 November2023.

Rental market

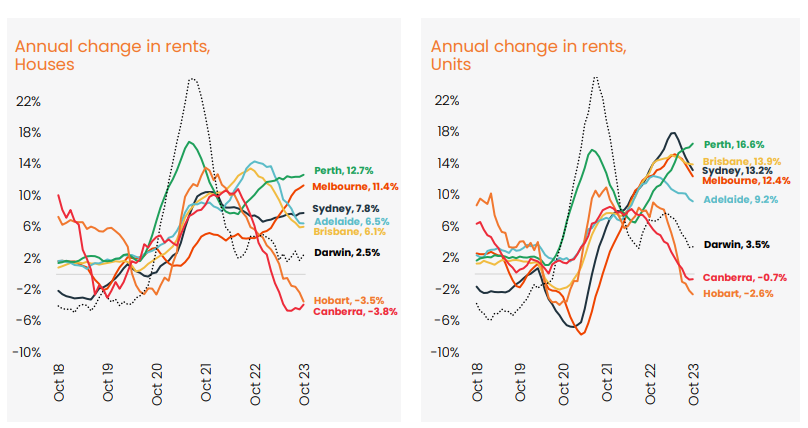

In October, rental vacancies hit a new record low, reaching 0.9% in combined capital cities and 1.2% in combined regional markets. Nationally, rental listings were 35.5% below the previous five-year average and 16.1% lower than a year ago. Despite the tight rental supply, rent growth has slowed and become more diverse. The quarterly rental growth in combined capitals decreased from 3.1% to 1.8%, mainly due to a slowdown in the unit sector.

Perth stands out with the highest annual rental growth, showing a 12.7% increase in house rents and a 16.6% increase in unit rents over the past year. On the other hand, Hobart and Canberra have vacancy rates closer to average levels, and rents are falling annually. Gross rental yields seem to have peaked as property values rise and rental growth decelerates. Nationally, gross yields peaked between February and April at 3.73% and have since trended down to 3.69% in October.

Source: CoreLogic Hedonic Home Value Index, 2 October 2023.

Outlook

The historically low supply of available housing has been a key factor in the market’s recent growth, but now, new listings are outpacing active buyers, leading to higher inventory in some markets. This dynamic provides buyers with more options and greater negotiation power.

A subtle shift in market conditions is evident in declining auction clearance rates, which have dipped from the low 70% range in May to the mid-60% range in October. While the supply of properties for sale is expected to rise further, the outlook for buyer demand is clouded by persistently low consumer sentiment, influenced by factors such as inflation, speculation about interest rate hikes, and global tensions.

The prospect of higher interest rates is another challenge, making it more challenging to access credit. Consequently, the rate of housing value growth is likely to decrease in the coming months, with varying impacts across different markets. For instance, Sydney and Melbourne are experiencing a slowdown due to increased supply and affordability issues, whereas Perth, Brisbane, and Adelaide may be less affected due to ongoing supply shortages and lower affordability hurdles.

On a more positive note, labor markets have improved, and unemployment remains low, reducing the risk of mortgage defaults or distressed home sales. Additionally, the persisting housing under-supply may continue to exert upward pressure on property prices over the medium term. Furthermore, the exceedingly tight rental market may encourage renters to consider home purchases. However, financial obstacles such as saving for a down payment and qualifying for a mortgage remain significant challenges for prospective homebuyers.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.