Welcome to our May 23 Property Market Snapshot.

May at a glance

- National dwelling values rose by 0.5% over the previous month,

- The four largest capital cities all saw a increase in values,

- Sydney saw the largest increase (1.3%),

- Darwin was the only capital to record a decline (-1.2%).

Dwelling values

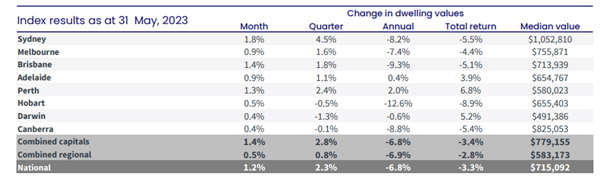

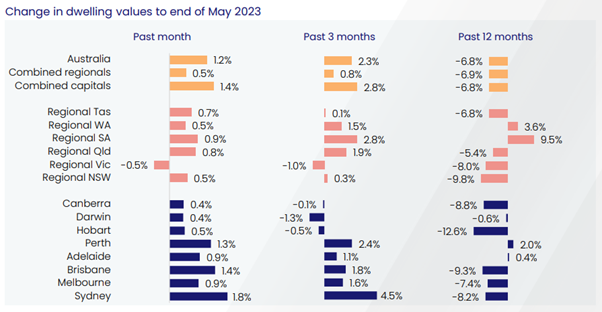

Home values in Australia have experienced a third consecutive monthly increase, with growth accelerating to 1.2% in May.

Sydney leads the recovery, with a 1.8% increase in home values, the highest monthly gain since September 2021. Brisbane and Perth also recorded monthly gains of more than 1.0%, and overall, the rate of growth accelerated across all capital cities.

The positive trend is attributed to low housing supply and increasing demand. Advertised listings decreased, and inventory levels are significantly lower than the previous year and the five-year average. As a result, buyers are becoming more competitive, auction clearance rates are high, and private treaty sales are faster with less discounting.

Source: CoreLogic Hedonic Home Value Index, 1 June 2023.

Regional housing values have also increased but at a slower pace than in the cities. Premium housing markets in Sydney are leading the recovery, with the highest rate of growth in the upper quartile. Despite these gains, most housing markets are still below their recent peaks, except for Perth, while Hobart has the lowest values compared to its recent cyclical peak.

Source: CoreLogic Hedonic Home Value Index, 1 June 2023.

Rental market

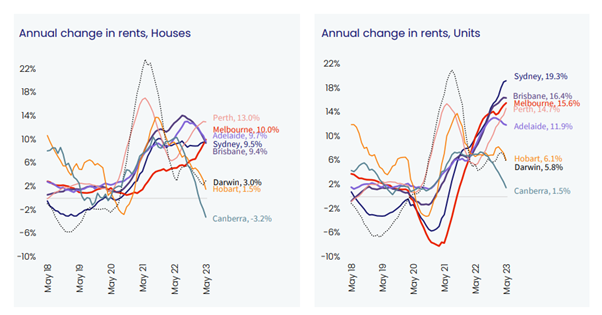

In May, the national rental index in Australia experienced a 0.8% increase, surpassing the average of the pre-COVID period. However, this growth rate indicates a slight deceleration compared to previous months.

Regional markets saw slower rental growth at 0.3%, while capital city rents increased by 1.0%. Unit rents exhibited stronger growth compared to house rents. Despite high rental demand, limited supply has led to lower vacancy rates and reduced rental listings. The market has seen increased investor participation, although investment loan volumes remain lower than the previous year.

Source: CoreLogic Hedonic Home Value Index, 1 June 2023.

Outlook

The housing market looks to have successfully rebounded from a previous downturn, displaying consistent growth in home values over the past three months. However, ongoing uncertainties, such as the potential for interest rate hikes, mortgage stress, and low consumer sentiment, persist.

The impact of higher housing prices on inflation and subsequent interest rate decisions adds to the complexity. The interplay between demand from overseas migration and limited housing supply continues to shape the market dynamics.

While risks of increased mortgage stress as fixed-rate home loans reach maturity exist, they are somewhat mitigated by the robust labor market conditions and accumulated household savings.

Ultimately, the future trajectory of the housing markets hinges on the uncertain path of interest rates, making it a crucial factor to watch closely.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Tania Minchella

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.