March at a glance

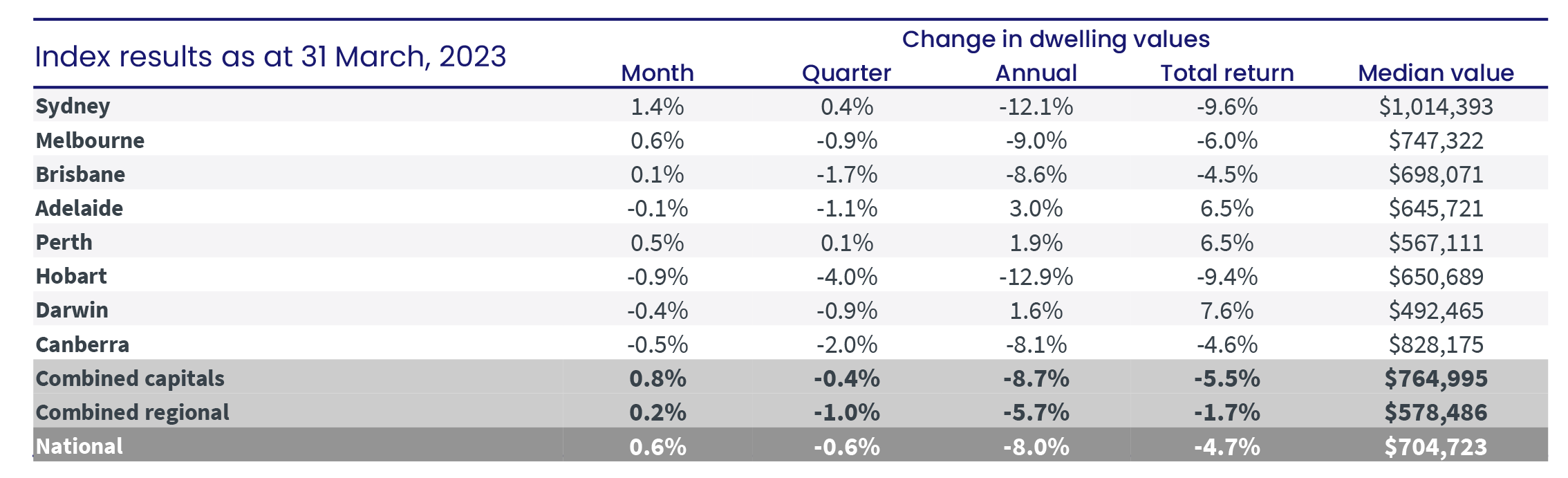

- National dwelling values rose by 0.6% over the previous month,

- Sydney saw a 1.4% in increase in values,

- The largest declines were recorded once again in Hobart (-0.9%),

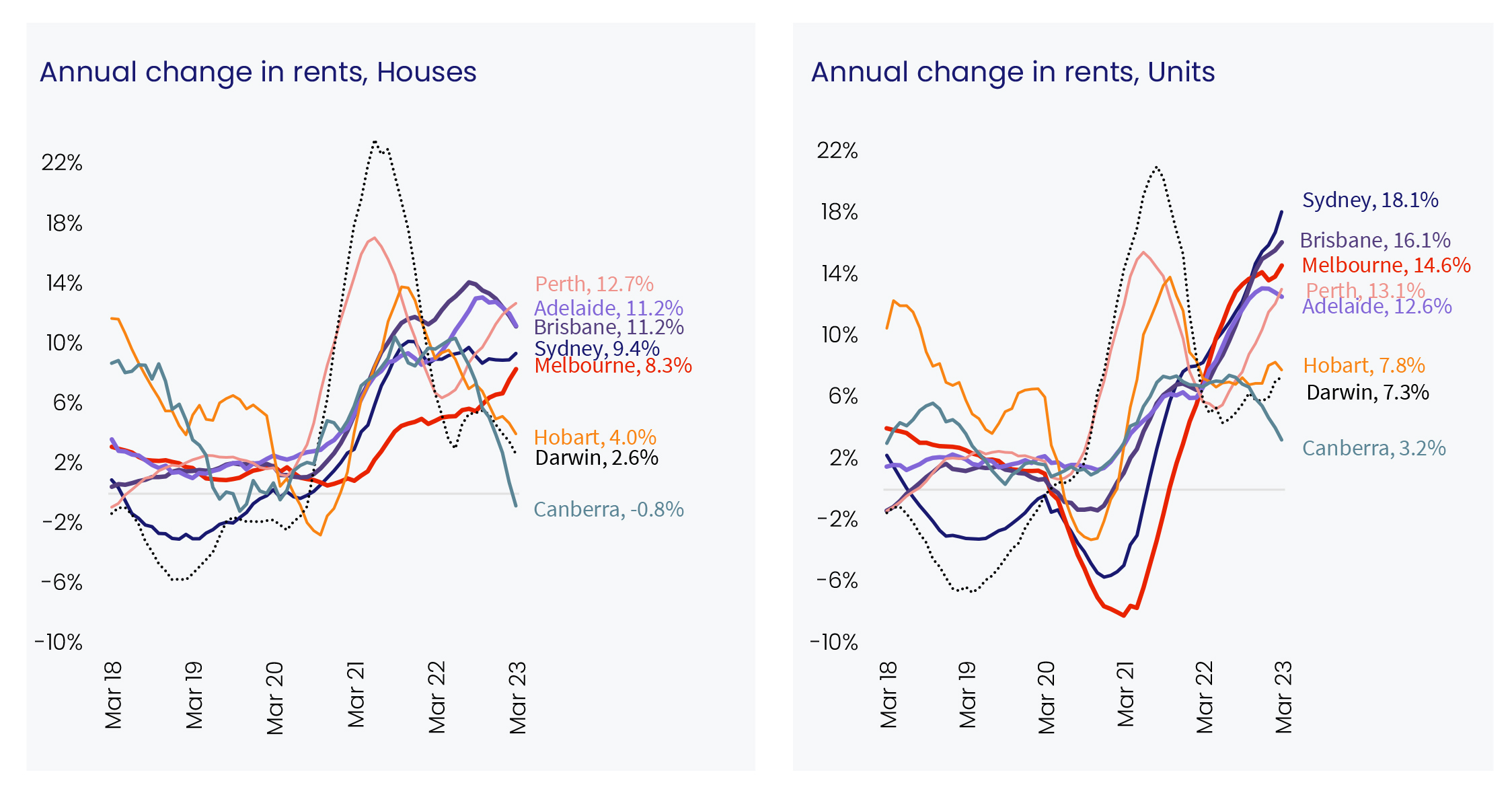

- Whilst rent prices continue to rise in many areas, not all cities and regions recorded a rise including Darwin houses (-1.5%) and units (-0.4%) as well as ACT houses (-1.3%).

Dwelling values

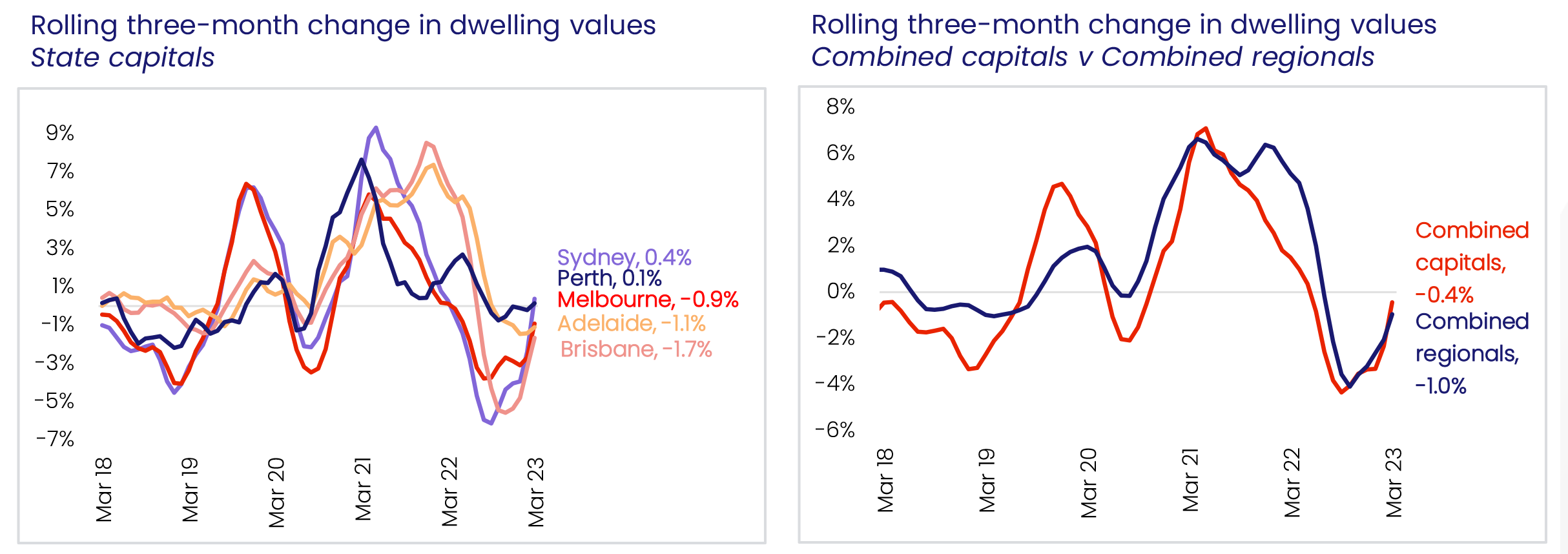

After ten consecutive months of falling home values, March saw a turnaround with a 0.6% increase in national home values.

This rise in housing values has been most prominent in Sydney, with the upper quartile of the housing market experiencing a 2.0% increase in March. Although interest rates are high, other factors like low advertised stock levels, tight rental conditions, and additional demand from overseas migration are putting upwards pressure on home prices.

Source: CoreLogic Hedonic Home Value Index, 3 April 2023.

Source: CoreLogic Hedonic Home Value Index, 3 April 2023.

While housing values are rising across most regions, there are still some areas where values have declined. Hobart recorded the largest drop in home values among the capital cities, down -0.9% over the month. However, the pace of decline has been easing over the past three months.

Source: CoreLogic Hedonic Home Value Index, 3 April 2023.

The demand for rental properties has been so high that it’s likely we are seeing some spillover from renting into purchasing, and with net overseas migration at record levels and rising, more permanent or long-term migrants may fast-track their home purchase due to the inability to find rental accommodation.

Rental market

The rental markets nationally are diverse but vacancy rates remain tight. Rental growth is accelerating in most large capitals, particularly in the unit sector, but slowing down in smaller capitals for houses. Sydney’s unit rental growth is now almost double that of houses. The rise in unit rents in Sydney and Melbourne was at a record high over the March quarter. House rents have increased by 24.8% since March 2020, while unit rents have risen by 19.5%.

Source: CoreLogic Hedonic Home Value Index, 3 April 2023.

Outlook

During its March meeting, the Reserve Bank decided to maintain the current level of the official cash rate, which offered borrowers a respite from any further increase. Nevertheless, it remains to be seen how much higher interest rates will affect the economy, especially with about 30% of the outstanding housing credit on a fixed interest rate. This is a considerably larger proportion of borrowers than usual who have yet to experience the 350 basis points of rate hikes thus far.

Despite some encouraging indications in the housing market during March, prudence is necessary before declaring a trough in the cycle.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Tania Minchella

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.