February at a glance

- National dwelling values reduced by a 0.1% over the previous month,

- Sydney actually saw a 0.3% in increase in values however is not expected to be a sign that the market is turning,

- The largest declines were recorded in Hobart (-1.4%) and Canberra (-0.5%),

- There were 24,658 new listings over the 4 weeks ending 26 February which is significantly up on January however remains 17% lower than this time last year,

- National rent prices continue to rise based on strong demand for rental properties.

Dwelling values

The value of Australian property at a national level declined by 0.1% in February. The downward trend noted across every state with the exception of Sydney which surprisingly recorded an increase of 0.3% in property value. The greatest decline was again seen in Hobart which had values reduce by by 1.4% in the month and is down 11.8% on an annual basis.

Despite the continued downward trend across the country, housing values remain higher than they were prior to COVID which shows the resilience of the property market.

Source: CoreLogic Hedonic Home Value Index, 1 March 2023.

Source: CoreLogic Hedonic Home Value Index, 1 March 2023.

The was some consistency in the value changes in most states where prices reduced between -0.1% and -0.5%. The median value of property in Sydney rose above the one million again to be $1,006,923, and is $743,554 in Melbourne, $694,4954 in Brisbane, $645,812 in Adelaide, and $561,740 in Perth.

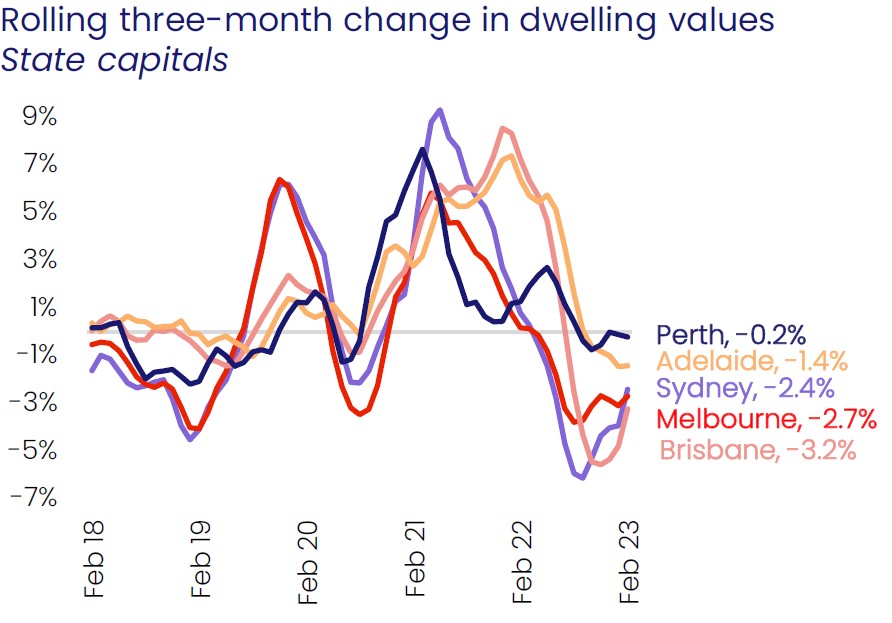

The graph below depicts the rolling three-month changes in housing values over the past five years in some states across Australia. We can see the peak in capital growth during 2021, the sharp fall during 2022 to get to what seems the trough, and then a slowdown in decline early in 2023.

Source: CoreLogic Hedonic Home Value Index, 1 March 2023.

With interest rates still rising and adding to the cost of living woes for consumers, the potential for more price falls exists which may be positive for first home buyers. However, the low level of stock on the market is helping to mitigate a greater fall in values.

Subdued seller appetite continues

The last month saw a seasonally expected rise in the number of new properties advertised for sale, however listing numbers continues to be low due to a reluctance from homeowners to test the market. There were 26,657 new listings in the 4 weeks ending 26 February, up from the 16,770 the prior period. Despite this seasonal jump, this figure remains 17% lower than this time last year, and 12% lower than the 5 year average.

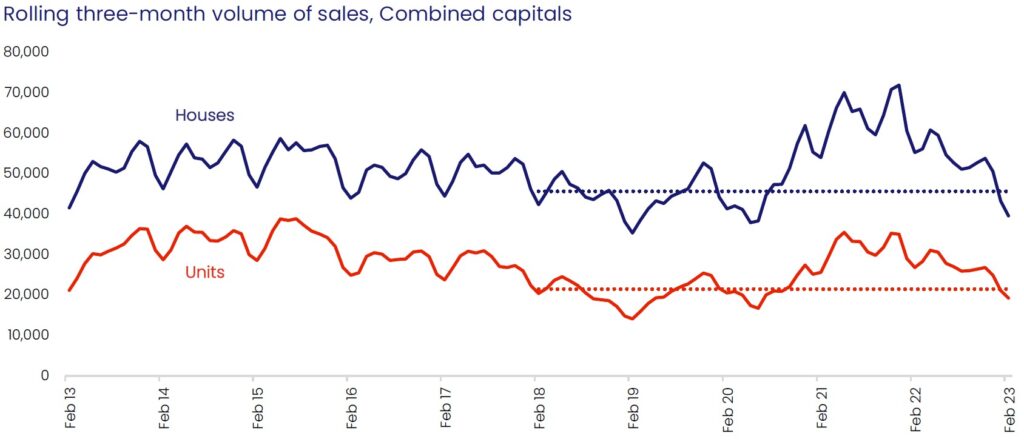

With auction clearance rates moving above 70%, there has been a lift in sales which denotes demand during the month of February may have exceeded supply.

Source: CoreLogic Hedonic Home Value Index, 1 March 2023.

Rental market

National rental appreciation continued during February with unit increasing more that that of houses. Sydney units have reached an annual change of 16.7%, while Brisbane rents are up 15.6%, and Melbourne up by 13.9%. Comparing this to the states that performed best in house rental growth, Perth increased by 12.4%, Adelaide 12.0%, and Brisbane 11.9%.

The strong demand for rental properties, particularly units, is underpinned by a limited supply of available properties, a return to normal overseas migration, and consumers moving to more affordable rental accommodation.

“Rental affordability pressures may be forcing a transition of demand towards higher density rental options. Additionally, the strong rebound in foreign student and international migrant arrivals would be

adding to rental demand, particularly in inner city precincts as well as areas within close proximity to universities and transport hubs” noted Tim Lawless, research director at CoreLogic.

Outlook

In it’s March meeting, The Reserve Bank opted to increase the official cash rate by a further 0.25% to now be at the highest level since May 2012. There is an expectation in the market for a further 0.50% rise to combat increasing inflation which may cause serviceability issues for some borrowers.

Rents will likely continue to increase over the next quarter due to the record low vacancy rates which will place more pressure on those looking for new rentals.

Low supply of listings are expected to continue as potential sellers resist going to market while prices are falling. The low stock level may also provide an opportunity for some motivated owners to tap into the existing buyer demand and decide to sell while competition is low.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.