September at a glance

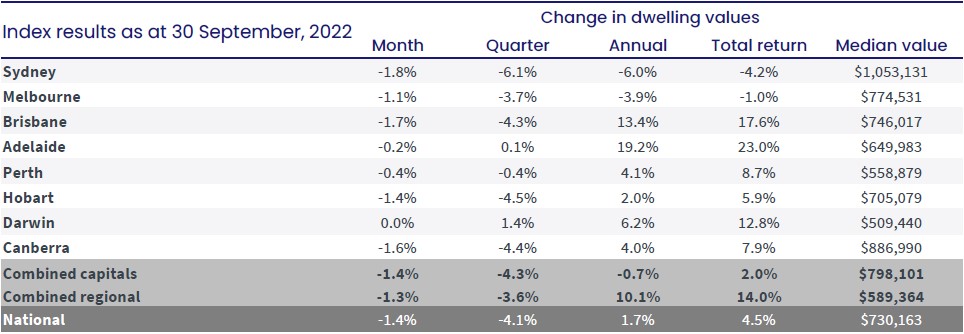

- At a national level, dwelling values reduced by 1.4% over the month,

- The most significant drops were again in Sydney (-1.8%), Brisbane (-1.7%), Canberra (-1.6%) and Hobart (-1.4%),

- Darwin was the only city to not see housing values decline, but neither did they rise,

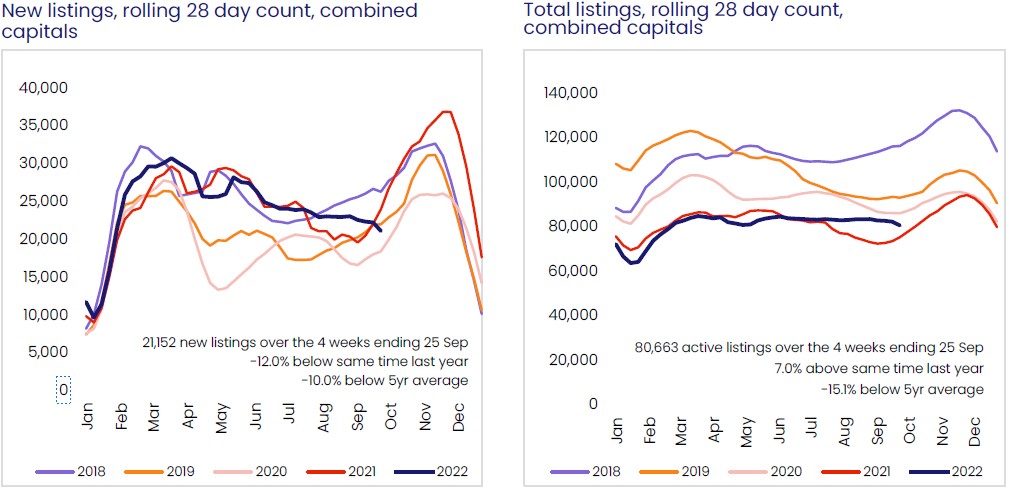

- There were 21,152 new properties advertised for sale in the 4 weeks to 25 September which is lower than last month,

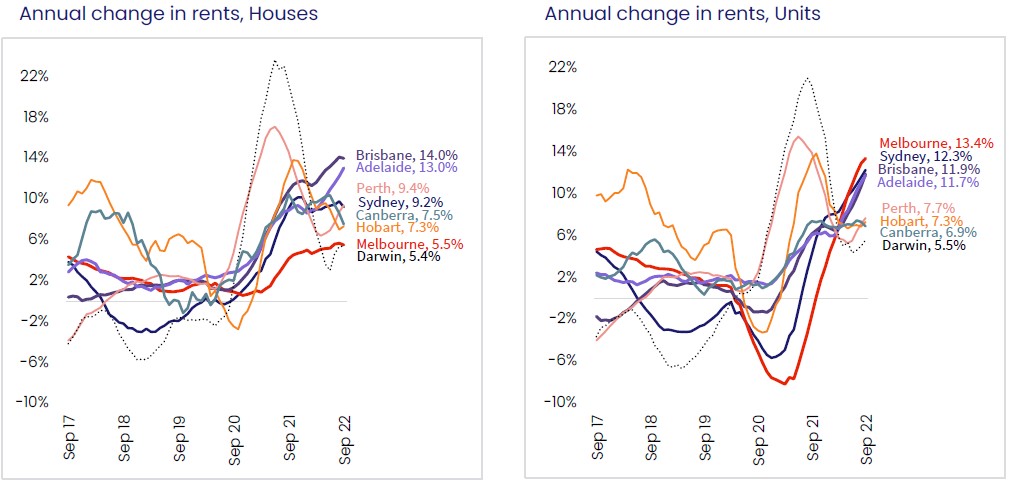

- Rents increased by 0.6% nationally but the strong growth is starting to ease.

Dwelling values

Values at a national level have declined by 4.1% over the past quarter, contributed by a 1.4% drop over September. The market still remains up by 1.7% over the last 12 months, with regional areas showing values 10.1% higher than this time last year.

No state or territory achieved an increase in house values over the month, Darwin being the last to see their market turn. While we are seeing values across the country fall from their peak, we need to be mindful that property prices move in cycles and so this not new territory. Also of note is that housing valued at a national level increased by 28.6% from the onset of COVID until the market peak, so home owners have had significant capital growth despite the recent easing.

Source: CoreLogic Hedonic Home Value Index, 1 October 2022.

Source: CoreLogic Hedonic Home Value Index, 1 October 2022.

The downward pressure on dwelling values is viewed favourable by consumers looking to enter the property market, particularly first home buyers due to median house prices returning to a more normalised level. Median values are currently $1,053,131 in Sydney, $774,531 in Melbourne, $746,017 in Brisbane, and $649,983 in Adelaide.

The consecutive monthly rise in the cash rate target by the Reserve Bank since 4 May 2022 totalling 2.50% remains the main driver of reduced demand and therefore values in housing.

Inventory

There were 21,152 new properties advertised for sale in the 4 weeks ending 25 September. This is 12% lower than the same time last year and depicts a slow start to the traditionally strong spring selling season.

Source: CoreLogic Hedonic Home Value Index, 1 October 2022.

“It seems prospective vendors are prepared to wait out the housing downturn, rather than try to sell under more challenging market conditions,” said Tim Lawless, Research Director at CoreLogic.

The fact new listings are not high supports the notion of home owners not feeling a need to sell due to financial stress on the back of climbing home loan interest rates. It also maintains some scarcity on the properties available to buy which may also be a factor helping to keep prices from steeper falls.

Rents

Rental prices increased in September by 0.6% which saw further cooling from its peak in May 2022. The annual change in the price of renting houses hit 14% in Brisbane, 13% in Adelaide, and over 9% in Perth and Sydney. Tenants in these states would welcome the slight relief from the rents easing in recent months, but are likely to remain wary due to existing rental vacancy rates being very low and overseas migration on the increase.

Source: CoreLogic Hedonic Home Value Index, 1 October 2022.

Source: CoreLogic Hedonic Home Value Index, 1 October 2022.

Outlook

The inflation figure measured each month is likely to be the key determinant of what will transpire within the property market over the final months of 2022. It seems inflation may have seen its peak and be on its way down which may stay the hand of the Reserve Bank from increasing the cash rate target further.

It is still anticipated that new properties advertised for sale will increase as is usually the case in spring, however may not be as strong as historically is the case.

The biggest unknown is the impact that the rising mortgage rates will have on borrowers. At present there has not been any discernible trends in loan defaults on the back of rising rates on home loans. There is however, a large proportion of fixed-rate borrowers whose loan will revert to a much higher variable rate in the next 12 months that will face a ‘repayment shock’ which may have an impact in the volume of properties hitting the market, and any change in values.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.