At a glance

- 6 out of 8 capital cities record a lift in housing values

- September saw housing values in our two largest states decline while for all other capital cities, they continued to rise on the back of growing consumer sentiment

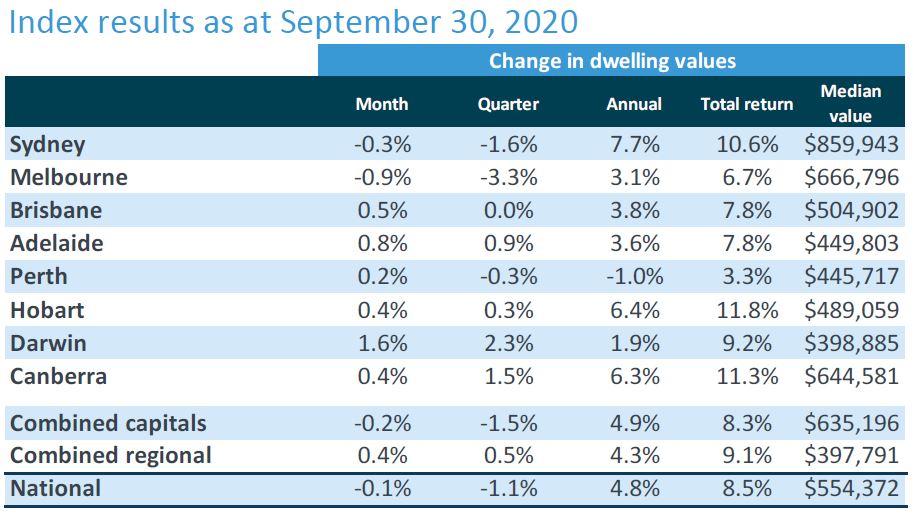

- Values reduced at a national level by a 0.1% for the month, and by 1.1% for the quarter. This was driven by Sydney (-0.3%) and Melbourne (-0.9%), the later due to the ongoing restrictions in place to curb the spread of COVID-19

- The remaining states have shown strong resilience to record a rise in values. Darwin is leading the charge with growth of 1.6% for the month, followed by Adelaide which increased by 0.8%

Source: CoreLogic Hedonic Home Value Index, 1 October 2020.

Some uncertainty remains in the housing market outlook as we will see a reduction in fiscal support and banks pulling back on their mortgage payment deferrals. The current low interest rate environment and the low number of new properties hitting the market (22% lower than 12 months prior) should ensure property prices remain insulated from the impacts of COVID-19.

CoreLogic head of research, Tim Lawless said “We aren’t seeing any signs of a rise in distressed listings or stock starting to pile up in the market. In fact, the opposite seems to be true, where new listings are being absorbed by the market faster than the rate at which they are being added”.

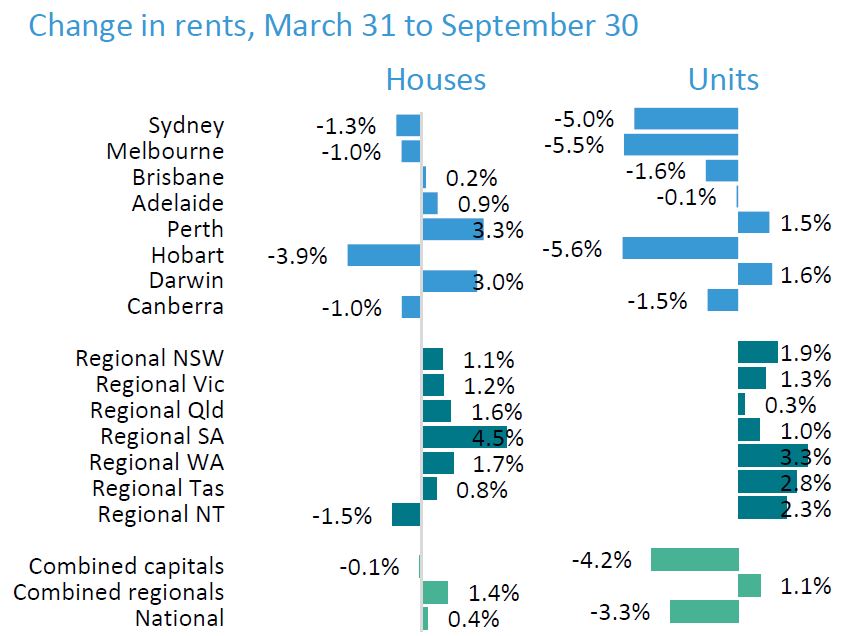

In terms of the rental market, we see a growing difference between house and unit rents. In the last 6 months, house rents nationally have risen by 0.4% while unit rents dropped by 3.3%. This is far greater in Sydney where rents have reduced by 5%, and Melbourne where they are down 5.5%; while house rents fell only by 1.3% and 1.0% respectively.

Source: CoreLogic Hedonic Home Value Index, 1 October 2020.

Some of the reasons behind the larger impact on unit rents in capital cities include a large number of recent newly built apartments in Sydney and Melbourne, international and state border closures, and marked drop in overseas migrants, particularly students.

Regional rent markets have performed better where rents rose for both houses and units by 1.4% and 1.1% respectively over the past six months.

There is an expectation of continued high supply and weak rental conditions in the unit market until borders are reopened which might negatively impact prices of inner-city and investor-owned units.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.