Welcome to our November 23 Property Market Snapshot.

October at a glance

- November’s Home Value Index (HVI) saw a 0.6% increase, marking the smallest monthly gain since February’s growth cycle.

- City-specific variations included declines in Melbourne, Hobart, and Darwin, while Perth, Brisbane, and Adelaide displayed resilient growth.

- November’s capital city vacancy rates stood at 1.0%, with Adelaide, Perth, and Melbourne reporting the lowest rates.

Dwelling values

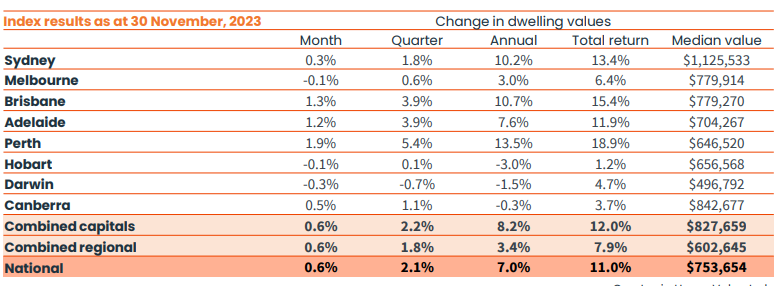

In November, the national Home Value Index (HVI) saw a modest 0.6% increase, marking the smallest monthly gain since the growth cycle’s onset in February. Despite this deceleration, the national HVI reached a new record high. Over the past 10 months, housing values rebounded by 8.3%, demonstrating a clear ‘V’-shaped recovery after a -7.5% decline from April 2022 to January 2023.

While overall trends slowed, city-specific variations emerged, with Melbourne, Hobart, and Darwin experiencing declines, and Sydney’s growth slowing sharply to 0.3%. There is a possibility of Sydney’s home values stabilizing or decreasing in December. Conversely, Perth witnessed accelerated housing values with the largest monthly gain since March 2021 at 1.9%, and Brisbane and Adelaide displayed resilient and rapid growth.

Slower growth conditions in the upper quartile of Sydney and Melbourne suggest a shift in demand towards lower housing price points. The gap between regional and capital city growth rates has narrowed, with both indices recording a 0.6% rise in November. Regional Australia’s housing values remain -1.8% below the historic high recorded in May 2022, with Regional Victoria and Regional NSW showing the largest shortfalls at -6.7% and -5.5%, respectively.

The housing slowdown is attributed to a notable increase in vendor activity, particularly during the atypical early winter season following a prolonged period of below-average new listings. The continuous rise in selling activity since June aligns with a deceleration in home value growth. Total stock levels have been climbing since July, indicating that purchasing demand is not keeping pace with the surge in vendor activity, according to Mr. Lawless.

In the four weeks ending November 26th, advertised stock levels were above the previous five-year average in Hobart, Canberra, Melbourne, and Sydney. In these cities, favorable market conditions for buyers have emerged due to higher stock levels, offering more choices and negotiation opportunities. Conversely, Perth, Brisbane, and Adelaide maintain remarkably low advertised stock levels, with Perth listings nearly -40% below the five-year average. Despite the low stock levels, these cities continue to experience a consistently high rate of growth amid robust selling conditions.

As the spring selling season concludes, the influx of new listings is reaching a seasonal peak. With selling activity expected to slow in the first two months of summer, vendors will have an opportunity to assess market conditions and adjust pricing expectations. Despite the high cost of debt and pessimistic consumer sentiment, purchasing activity has held reasonably firm. Quarterly sales activity across combined capitals aligns with the previous five-year average, while regional demand is modestly increasing from below-average levels.

Source: CoreLogic Hedonic Home Value Index, 1 December 2023.

Rental market

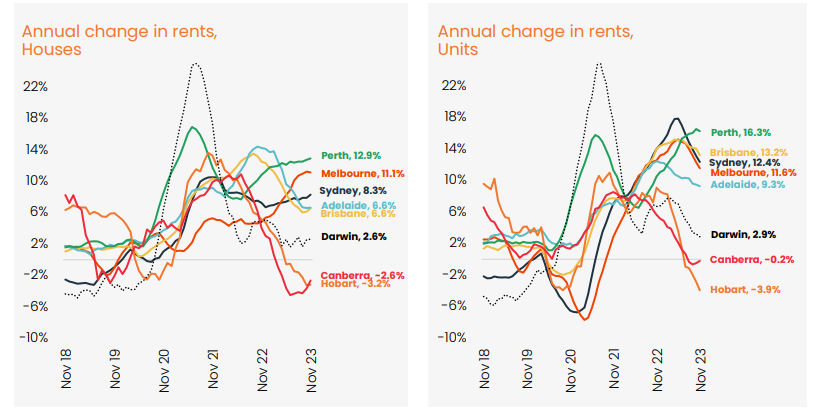

During the month, vacancy rate of 1.0% in capital cities. Adelaide, Perth, and Melbourne reported the lowest vacancy rates, while Sydney and Brisbane recorded rates below the average. National rents have consistently risen since August 2020, spanning 40 months, and the upward trend in the quarterly figures has continued over the last two months.

Despite the overall upward trajectory, some markets experienced a softening in rental conditions. Hobart and Canberra reported higher vacancy rates at 1.9% and 1.7%, respectively, providing relief for both house and unit rents. Conversely, Perth led the nation in rental cost growth, with house rents increasing by 3.1%, and unit rents rising even faster at 3.4% over the three months ending November.

Notably, November marks the first time in six months where rents have increased at a faster rate than home values, offering support for gross rental yields at the national level. While gross yields stabilized between early 2022 and early 2023 as housing values fell and rents rose, they compressed again as value growth outpaced rent growth. With the rate of home value growth slowing in most regions while rents continue to rise, there is potential for yields to trend higher in some cities. However, considering the costs of debt and increased maintenance expenses, net yields are likely to remain low for leveraged investors.

Source: CoreLogic Hedonic Home Value Index, December 2023.

Outlook

The housing market is experiencing a notable shift. Factors like low inventory that supported value growth are losing impact as advertised stock levels rise in some cities. Downside risks, including potential prolonged higher interest rates, worsening affordability, and persistent pessimistic consumer sentiment, are becoming more pronounced.

Looking to 2024, the housing market is expected to undergo significant changes. Anticipated trends include a focused effort to address housing undersupply, potential loosening of rental conditions, and a gradual shift towards greater diversity in housing value growth.

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.