Welcome to our June 23 Property Market Snapshot.

June at a glance

- Housing values in Australia increased moderately in June, with the national Home Value Index rising by 1.1%, slightly lower than the previous month.

- Except for Hobart, all capital cities experienced an increase in dwelling values, led by Sydney with a 1.7% rise in June.

- Regional housing values have been growing at a slower pace compared to urban areas.

- Rental growth in Australia is showing signs of easing, with the national rental index increasing by only 0.7% in June, the smallest monthly rise since January 2023.

Dwelling values

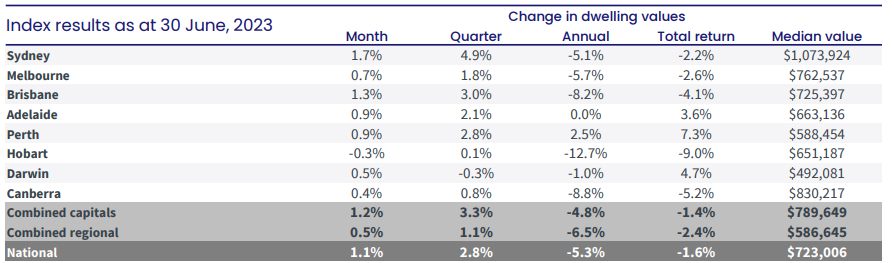

Housing values in Australia saw a moderate increase in June, although the pace of growth slowed compared to the previous month. The national Home Value Index rose by 1.1%, slightly lower than May’s 1.2% gain. Despite a recovery of 3.4% since February, housing values are still 6.0% below the peak levels of April 2022.

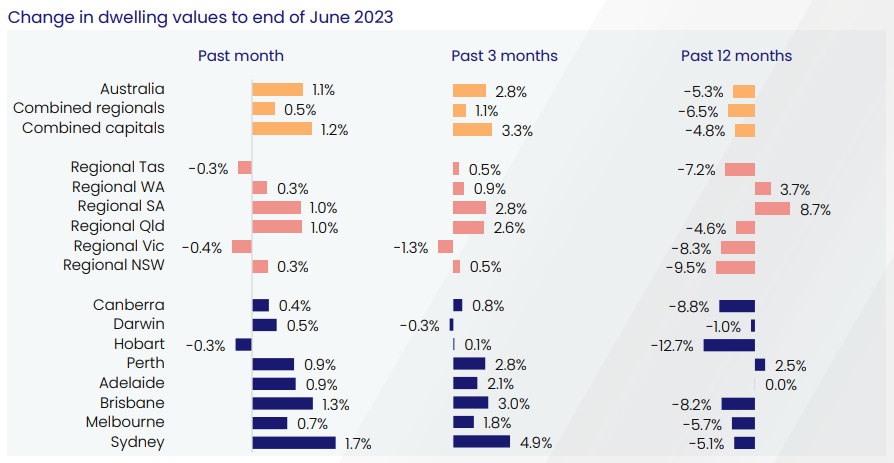

With the exception of Hobart, all capital cities experienced an increase in dwelling values, led by Sydney with a 1.7% rise in June. A lack of available housing supply has been a key factor driving up values, as new listings and inventory levels remain below average. However, the rate of growth has decelerated in most capital cities, possibly due to changing sentiment associated with rising interest rate expectations.

Source: CoreLogic Hedonic Home Value Index, 3 July 2023.

Regional housing values have also been on the rise, albeit at a slower pace compared to urban areas. The combined regional index recorded its fourth consecutive month of growth, with values 1.2% higher than the recent low in February. This slower growth in regional areas can be attributed to normalised internal migration trends and a preference for capital cities over regional locations for overseas migration.

While housing values have generally increased, most regions still have values below their previous peak levels. Hobart has seen the largest cumulative decline, with values remaining 12.9% below the record high of May last year. Perth is the only capital city where home values have reached new highs, while Adelaide is just 0.3% below its peak.

Source: CoreLogic Hedonic Home Value Index, 3 July 2023.

Source: CoreLogic Hedonic Home Value Index, 3 July 2023.

Rental market

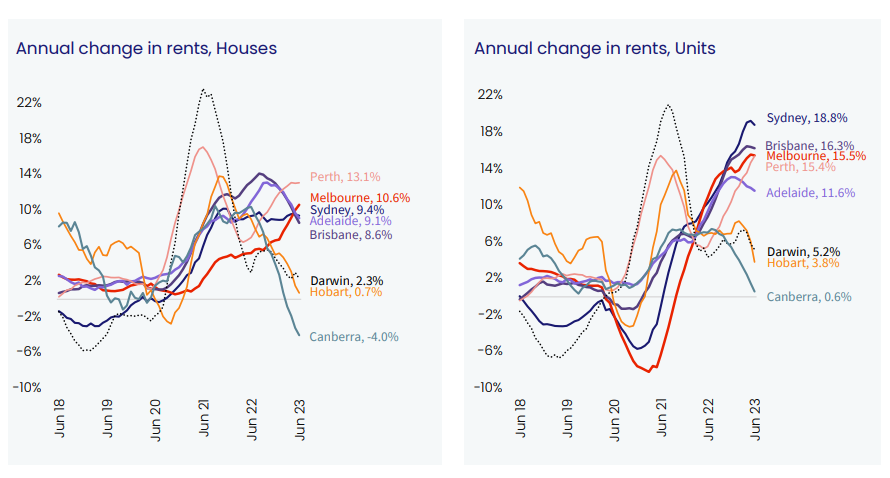

Rental conditions in Australia are showing signs of slowing growth. In June, the national rental index increased by 0.7%, marking a continued deceleration and the smallest monthly rise since January 2023, although it remains higher than the pre-COVID average. Annual rental growth in both capital cities and regional areas has also decreased, with capital cities experiencing a decline from a record high of 11.7% to 11.5%, and regional areas seeing a decline from 12.5% to 4.9%.

The slowdown in rental appreciation is noticeable across most cities and regions, with Canberra being the only capital city where rents have decreased by 2.8% over the past year. Hobart has also experienced a decline in rents in the past two months, resulting in an annual growth rate of just 1.3%. These markets have seen an increase in supply and vacancy rates. However, larger capital cities, particularly in the unit market, continue to experience stronger rental growth due to factors like overseas migration and limited rental supply.

Vacancy rates have slightly increased in recent months but remain below average levels. Regional areas have higher vacancy rates, rising from 1.3% to 1.5%, still below the decade average. Capital cities have also seen a slight increase from 1.0% to 1.1%, remaining well below the average. Some cities, such as Adelaide, have exceptionally low vacancy rates, with Adelaide recording the lowest rate at 0.4%. Perth and Melbourne also have low vacancy rates at 0.7% and 0.8%, respectively.

Source: CoreLogic Hedonic Home Value Index, 3 July 2023.

Source: CoreLogic Hedonic Home Value Index, 3 July 2023.

Outlook

The rebound in housing values can be partially explained by the limited supply of homes on the market. The number of homes advertised for sale in both capital cities and regional areas has decreased compared to last year and the average for this time of year. Despite the low inventory levels, the estimated volume of home sales is in line with the previous five-year average. This supply-demand imbalance has favored vendors, leading to higher auction clearance rates and smaller median discounting rates.

Considering that new listings are typically limited during winter, it is expected that the tight supply levels will persist in the coming months.

Despite the tight vacancy rates, rental appreciation is expected to continue slowing down due to affordability pressures and changes in rental household formation. Early indications of a rebound in the average household size suggest a shift in rental dynamics.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Tania Minchella

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.