October at a glance

- National house prices reduced by 1.2% over the previous month,

- The most significant drops were in Brisbane (2.0%), Sydney (-1.3%), Hobart (-1.1%), and Canberra (-1.0%),

- This was the first month that every city recorded a reduction in dwelling values,

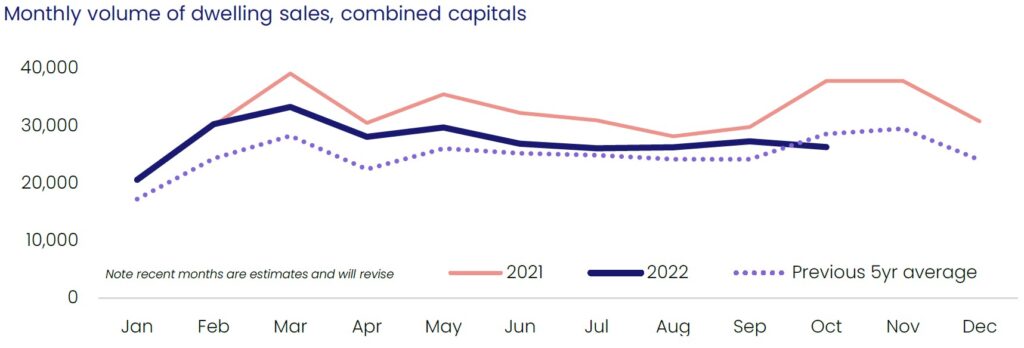

- There were 24,664 new properties advertised for sale in the 4 weeks to 30 October which is 25% below this time last year,

- National rents rose by another 0.6% driven by increases in unit rentals.

Dwelling values

Values reduced nationally for the sixth consecutive month following a 1.2% decline in October. Interestingly, the rate of decline is varying across regions. Brisbane recorded the steepest decline of 2.0% for the month, while across Sydney and Melbourne the decline has eased.

Source: CoreLogic Hedonic Home Value Index, 1 November 2022.

Source: CoreLogic Hedonic Home Value Index, 1 November 2022.

The disparity between the change in values in capital cities and regional areas are also starting the narrow. Over the last 12 months the values in regional areas were up 6.6% compared to being down 3.3% in the combined capitals. However, the performance levelled out over the last quarter. In the last month we’ve seen regional values reduce by a greater amount (-1.4% compared to -1.1% for the capitals).

The reduction in dwelling values across the country will benefit those buyers looking to enter the property market e.g. first home owners, due to median house prices returning to a more normalised level. Median values are currently $1,036,727 in Sydney, $767,117 in Melbourne, $728,615 in Brisbane, and $654,079 in Adelaide.

Source: CoreLogic Hedonic Home Value Index, 1 November 2022.

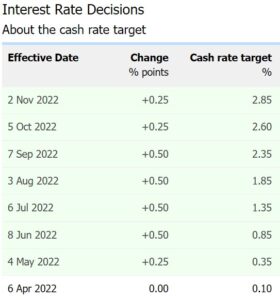

The actions by the Reserve Bank to combat rising inflation by increasing the target cash rate remains the main driver of reduced demand and house values. The 0.25% increase on 2 November means the RBA has taken rates up by 2.75% since 6 April 2022.

Source: Reserve Bank of Australia, accessed 9 November 2022, https://www.rba.gov.au/statistics/cash-rate/

CoreLogic’s Research Director, Tim Lawless noted “Despite the easing in the pace of decline, with Australian borrowers facing the double whammy of further interest rate hikes along with persistently high and rising inflation, there is a genuine risk we could see the rate of decline re-accelerate as interest rates rise further and household balance sheets become more thinly stretched”.

Rents

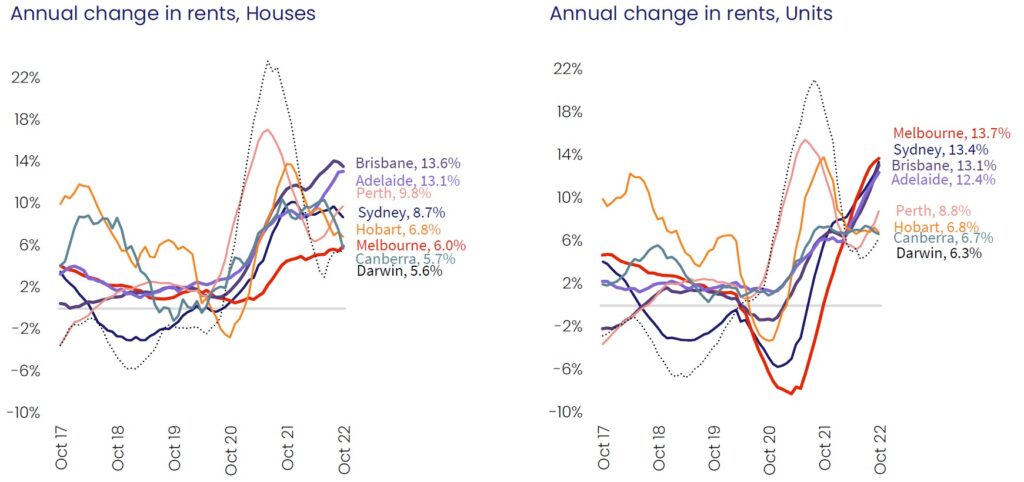

Rental prices increased nationally by 0.6% in October, as it did in the previous month. Unit rents led the charge by rising 1.1% compared to house rents which went up by 0.5%. This trend has been evident in most states and territories and sees people retuning to the higher density accommodation particularly in city areas.

A return of demand from overseas migrants has also contributed to this trend. This is evident in Sydney and Melbourne where rent growth for units are 13.4% and 13.7% higher respectively than what they were a year ago.

Source: CoreLogic Hedonic Home Value Index, 1 November 2022.

Source: CoreLogic Hedonic Home Value Index, 1 November 2022.

Outlook

Inflation will remain the key influence on house prices in the next few months due to the Reserve Bank signing its intention to raise the official cash rate target to keep it under control (which means higher mortgage interest rates).

Home owners who are looking to sell will have in most cases made significant capital gains. So despite housing values coming off in recent months, will still get a tidy return. It will take a little longer to sell in the current climate, but with the right agent and appropriate asking price, it will sell.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.